Bitcoin enjoys considerable diversity with both spot and futures markets available to retail and institutional investors, and recent statistics show that Bitcoin futures products offered by regulated exchanges such as CME and CBOE are witnessing growth, possibly indicating increasing institutional interest.

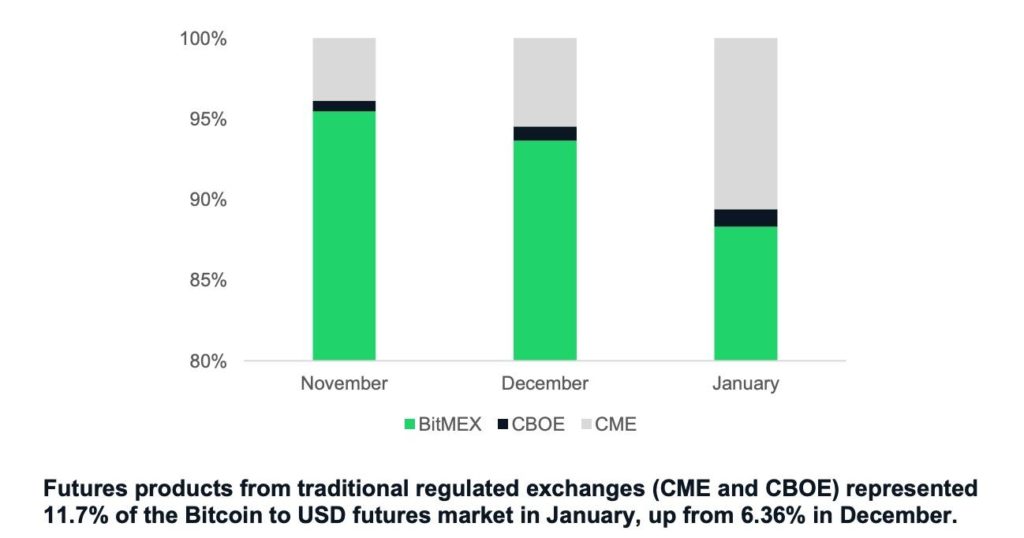

Firstly, as per a research report for January 2019, regulated exchanges witnessed an increase from 6.36% to 11.7%, between December 2018 and January 2019, when it comes to Bitcoin to USD futures trading. Even though BitMEX led the volume, CME saw significant uptake, followed by an increase in CBOE’s offering.

Given how most retail investors use BitMEX or other exchanges, the increase in CME and CBOE volumes indicates a possible increase in institutional involvement, which is not surprising given how more and more tier-A institutes and banks are keen on exploring the digital asset landscape.

Secondly, last week we also saw CME reporting the highest volume of Bitcoin futures contracts traded on the platform. On February 19, a total of 18,338 contracts were recorded, compared to a daily average of around 4,600 – in total, these contracts amounted to over $360M worth of Bitcoin traded.

Once again, given how these regulated products serve institutional investors, this spike is an important indicator in terms of where the market is headed. Bitcoin’s spot price also saw a major surge last week, and just yesterday BTC was trading at around $4,180, compared to its $3,400 low earlier this month.

However, the market corrected shortly afterward, with Bitcoin losing 9% and dropping to the $3,800 range. Some commentators are attributing the recent growth to JPMorgan’s launch of its own digital currency, the JPM Coin, and while the announcement may have brought attention to cryptocurrencies as a whole, JPMorgan’s foray into the crypto space is likely to have little to no effect on Bitcoin and other markets.

What is clear though, is that institutional investors are interested in crypto-related products and their involvement is likely to grow as we see more services being offered by reputable exchanges and regulated bodies.