In another entry for our “Crypto Hedge Fund Trading Strategies” series, we are going to discuss market making as one of the key strategies for generating alpha regardless of price action direction.

From our two funds – the first crypto fund of funds, and a direct, opportunistic fund – BitBull Capital has done diligence on hundreds of the 600+ crypto funds and their many strategies. BitBull Opportunistic then leverages the diligence we do with our Fund of Funds, where we focus on what strategies we see performing best in present market conditions.

What is market making?

Market making is a relatively low-risk, market-neutral strategy. Returns can be consistent, but often the market maker has a lot of inventory of the asset for which they are making a market. So, there is an opportunity cost to having much of that asset tied up in the strategy.

All markets require liquidity to function as we expect. When you execute a buy or sell order on any crypto exchange, you expect it to be filled almost instantly, but how does this happen?

All orders are only completed when there is someone else on the other end willing to either buy what you’re selling or sell what you’re buying. Once a coin or token reaches high organic trading volume figures, like Bitcoin, liquidity is easy, but what about other, less liquid coins? They need market makers.

Market making, as a strategy in crypto, is the buying and selling of a digital asset (typically staggered buying and selling) consistently at prevalent market rates to provide liquidity and allow markets to optimally discover price.

In the absence of market makers, an order book for a low-volume digital asset would be illiquid at best and extremely volatile at worst.

Example –

As a market maker in any market, you would set multiple ‘buy’ and ‘sell’ orders, where you will always sell higher and buy low.

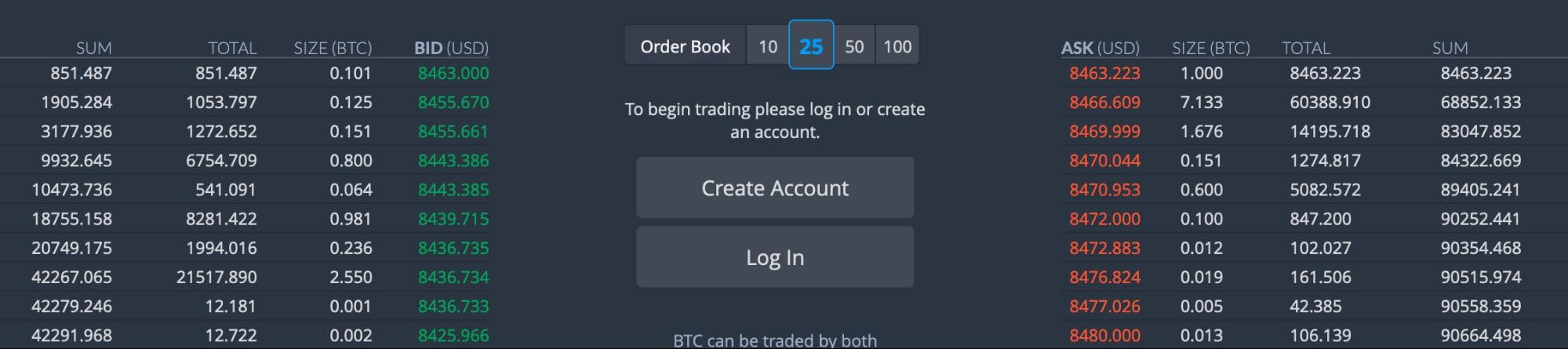

Looking at the screenshot below, from the BTC/USD market, we can assume, that as a market maker, I am selling right now at $8,463.223 and buying right now at $8,463.00

Screenshot from Bittrex

It doesn’t matter who buys or sells from me, so let’s say Joe wants to buy right now, he buys from me at 8463.223, – I have sold one Bitcoin for 8463.223

Now Jon comes, he wants to sell a bitcoin, he sells to me at 8463.000 – I profited 0.223 and still have 1 bitcoin back in my inventory. I do this repeatedly all day long, selling to people and buying from them.

Critical to understanding this is that market makers don’t work in a static market. They are often the lowest ask and the highest bid. and wait for a market order or a ‘taker’. So, when they set the bid at 8463, they will eventually have someone sell it to them for that, and when they set an ask at 8463.223, they will eventually have someone buy it from them at that. Market makers often use bots to automatically jump in front of the other lower orders when there is significant spread.

Understanding order book spreads

Order books for any asset exhibit the market’s depth and liquidity. On one side you can see the bids, which are buying offers, and on the other, you see asks, which are selling offers. The difference between the bid and ask is the spread, which is where a potential trader makes a profit.

However, a low-volume order book would typically have a much higher spread than an organically developed and mature order book. Hence, low-volume tokens present market makers more potential for profit.

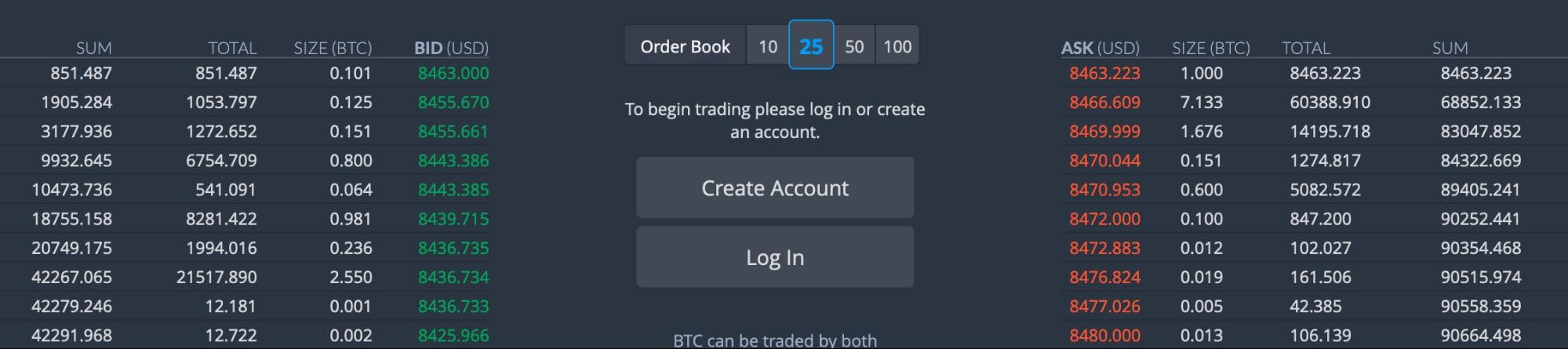

Bitcoin is the leading digital currency, which naturally makes it very liquid. A quick look at a BTC/USD order book shows the relatively low level of volatility a popular digital asset exhibits.

Screenshot from Bittrex

The market spread can be assessed by calculating the difference between bids and asks, and even if we take the second highest bid ($8455.670) and the second lowest ask ($8466.609), the spread is merely 0.13%.

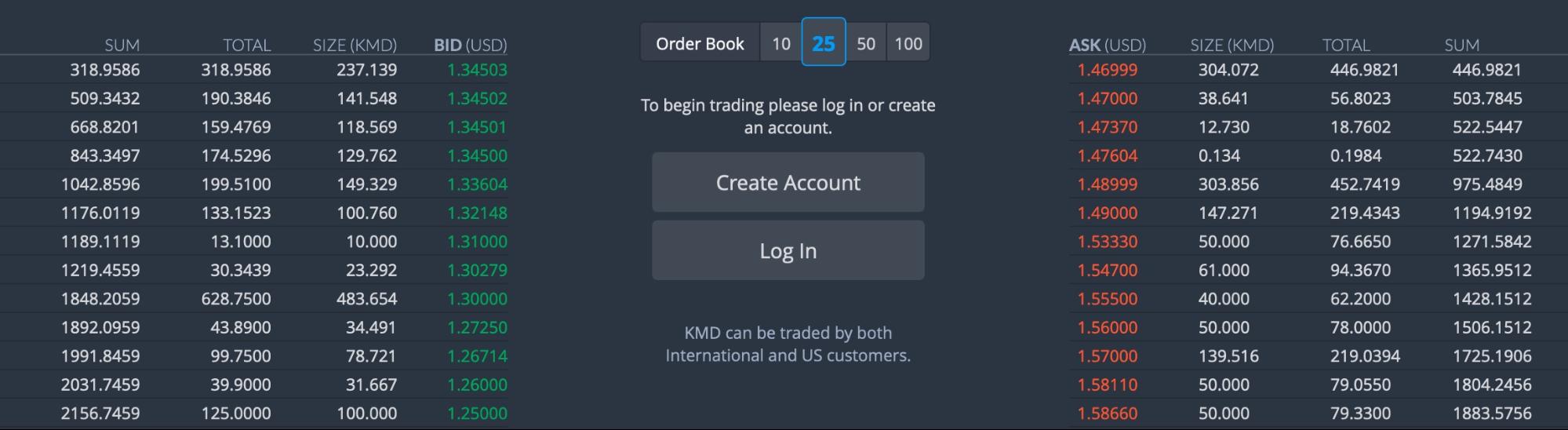

Now let’s take a look at the order book for KMD/USD market, which has significantly lower trading volumes and liquidity.

Screenshot from Bittrex

Here, the highest bid ($1.345) and the highest ask ($1.47) has a spread of over 9%, which is considerably more than the 0.13% we saw in the BTC/USD order book.

How do market makers profit?

The order book examples given above show the potential for profiting from minor differences in the bid and ask prices. Market makers identify markets with the highest potential to profit from these spreads and place orders on both sides of the book, buying and selling a digital asset while maintaining this spread. In doing so, market makers not only provide much-needed liquidity for the fluid functioning of any market but also make consistent gains.

The 9% spread we saw in the KMD/USD market is quite significant, but even lower spreads can be profitable when combined with high volumes of trades.

How does BitBull Capital profit from market making?

Market making is just one of the strategies we employ at BitBull Capital, and while it may not reap profits as high as early-stage investments (such as our Cosmos stake), it allows us to make consistent gains with prudent risk management and is a highly effective strategy regardless of market sentiment.

Managing and adjusting trading strategies is a critical component for active funds in order to generate optimal returns. You can read more about our strategies and research on our website, bitbullcapital.com and contact us with any questions you may have or inquiries about joining our crypto hedge fund.