Facebook’s foray into the world of digital currencies, namely project Libra, has not been received well by US lawmakers, who, in recent hearings, have raised concerns over data security, privacy and the tech giant’s history of breach of trust.

Naturally, all the regulatory attention also reflected on the crypto market, where Bitcoin, which had surged earlier following Facebook’s initial announcement, slumped following day one of the congressional hearings, which did not go so well for Libra.

Libra and Bitcoin considered threats to the financial system

There were concerns that stringent regulations designed for Libra may spill over to Bitcoin and other cryptocurrencies, and that is what happened today when US Treasury Secretary Steven Mnuchin spoke about Libra and Bitcoin during an interview with CNBC.

Mnuchin said he shared the President’s concerns over Bitcoin and cryptocurrencies in general. He also added that as of now, governments and central bank governors of the G7 countries have very significant concerns, particularly over Libra and broadly over cryptocurrencies.

He highlighted money laundering, consumer protection, and financial stability as major issues, and reiterated the US government’s commitment to implement hard measures to prevent the illicit use of cryptocurrencies.

“We’re going to make sure that Bitcoin doesn’t become the equivalent of Swiss-numbered bank accounts, which were obviously a risk to the financial system,” said Mnuchin.

Bitcoin slumps then rise

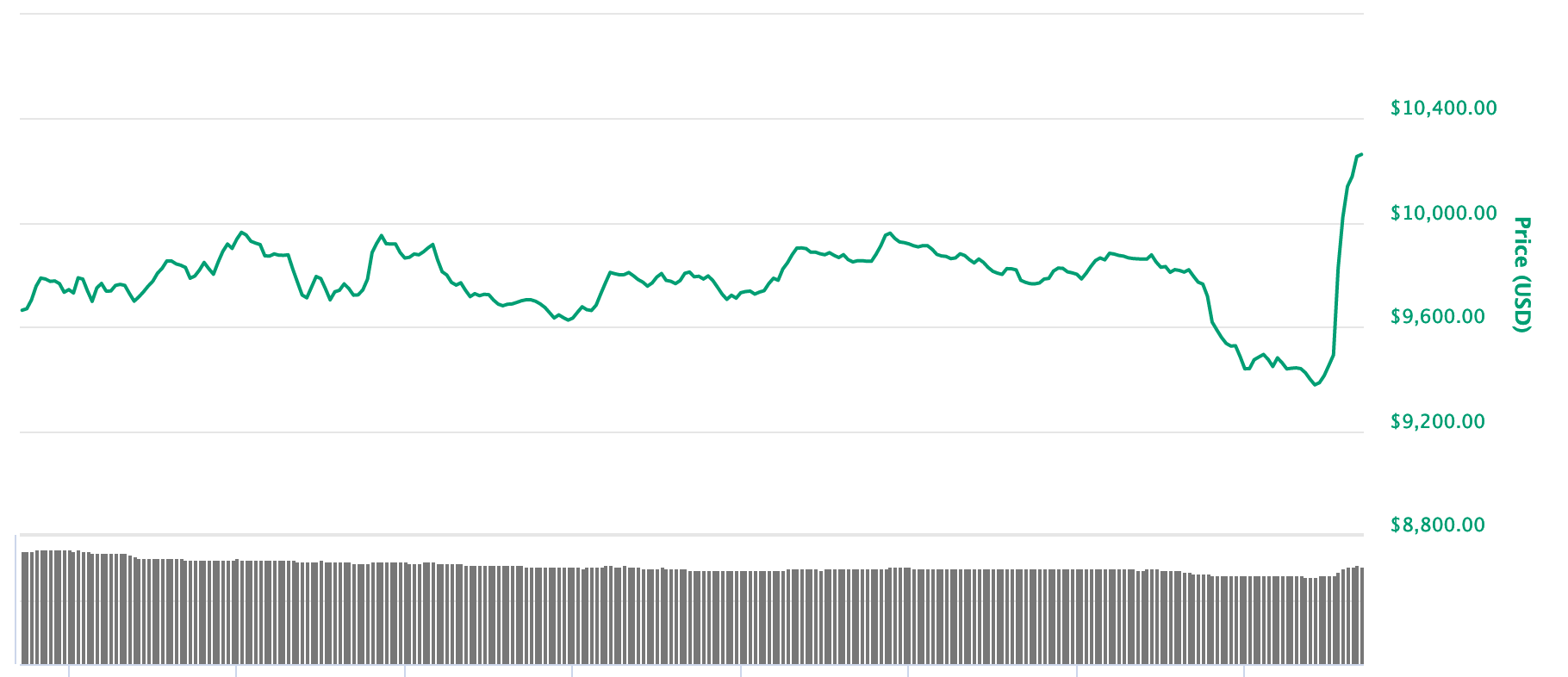

Bitcoin, which had already dropped below $10,000, was trading around $9,800 at the time these statements were made, and dropped quickly to $9,300 shortly after. However, the leading cryptocurrency rose just as quickly, and even before analysts could make sense of the drop, surged past $10,000 to trade at $10,400 at the time of writing.

The bright side for Bitcoin

In the congressional hearings and Mnuchin’s interview, it was clear that lawmakers have serious concerns about Libra foremost, and they do not see Bitcoin as the same thing. This bodes well for Bitcoin on two accounts.

- It is able to distinguish itself from privately developed currencies like Libra

- It is able to show the advantages of a decentralized currency (no single entity like Facebook controls it)

Moreover, given how lawmakers want Facebook to resolve their concerns before it can be allowed to launch Libra, an eventual approval may also apply to Bitcoin by default.

Meanwhile, even if Libra is not launched in the near future, the increased global attention and recognition of the benefits of digital currency payments can prop Bitcoin higher, promoting adoption.

In any case, the industry desperately needed regulatory clarity, which was not coming fast enough. Now, with Facebook spurring lawmakers into action with Libra, we can expect faster developments which should help the crypto space, particularly Bitcoin, find its footing moving forward.