An increasing number of private wealth managers, bankers, registered investment advisors and money managers are seeking crypto exposure for their clients. Given how digital currencies have cemented their place as legitimate assets, the demand for portfolio diversification and technology implementation is on the rise, prompting even large banks such as JPMorgan to test blockchain-based services.

Two of the major hurdles in crypto investment are market knowledge and safe custody, both of which are at the core of our services at BitBull Capital. Our funds, including a Crypto Fund of Funds and an Opportunistic Fund, ensure secure exposure to both, early-stage crypto/blockchain projects and mainstream digital currencies, such as Bitcoin.

SERVICE PROVIDERS

Trident

Administrator

Richey May

Auditor

Harney’s

Offshore Counsel

DMS

Regulatory Counsel

Cole Frieman Mallon

US Counsel

Crypto Volatility Can Mean Profits!

Learn the best performing strategies

At BitBull Capital, our funds, including a Crypto Fund of Funds and an Opportunistic Fund, ensure secure exposure to both, early-stage crypto/blockchain projects and mainstream digital currencies, such as Bitcoin. Our diversified set of services are aimed at facilitating entry into the world of digital assets and help Private Wealth Managers/Private Banks, RIAs and Money Managers diversify their portfolios.

Institutional-Grade Due Diligence

Our multi-faceted vetting process identifies the best funds

Diversified Active Crypto Hedge Fund Strategies

Arbitrage – ICOs – Event-driven – Quantitative – Protocol-focused

Secure And Transparent

Custodied assets – Annual tax form – Monthly NAV Statements – Monthly Investor Calls

Research and Thought Leadership

BitBull’s “Bull’s Eye View” presents our research and market outlook from our position at the center of crypto investing.

Proprietary Deal Flow

We source opportunistic deals for ourselves and our investors from our unique knowledge of the strategies, returns and deals of the 600+ crypto hedge funds

Compliant and Audited

External reviews by legal and auditors. Tax and IRS compliance are simplified. Investors receive an annual K1.

Become An Investor Today

Our Fund of Funds aims to invest in the leading equity and token investment funds. Similar to Venture Capital, we believe access to the most competitive deals can create significant alpha. Yet, you can invest in our funds without any lock-up; crypto can be a means of “liquid venture capital.”

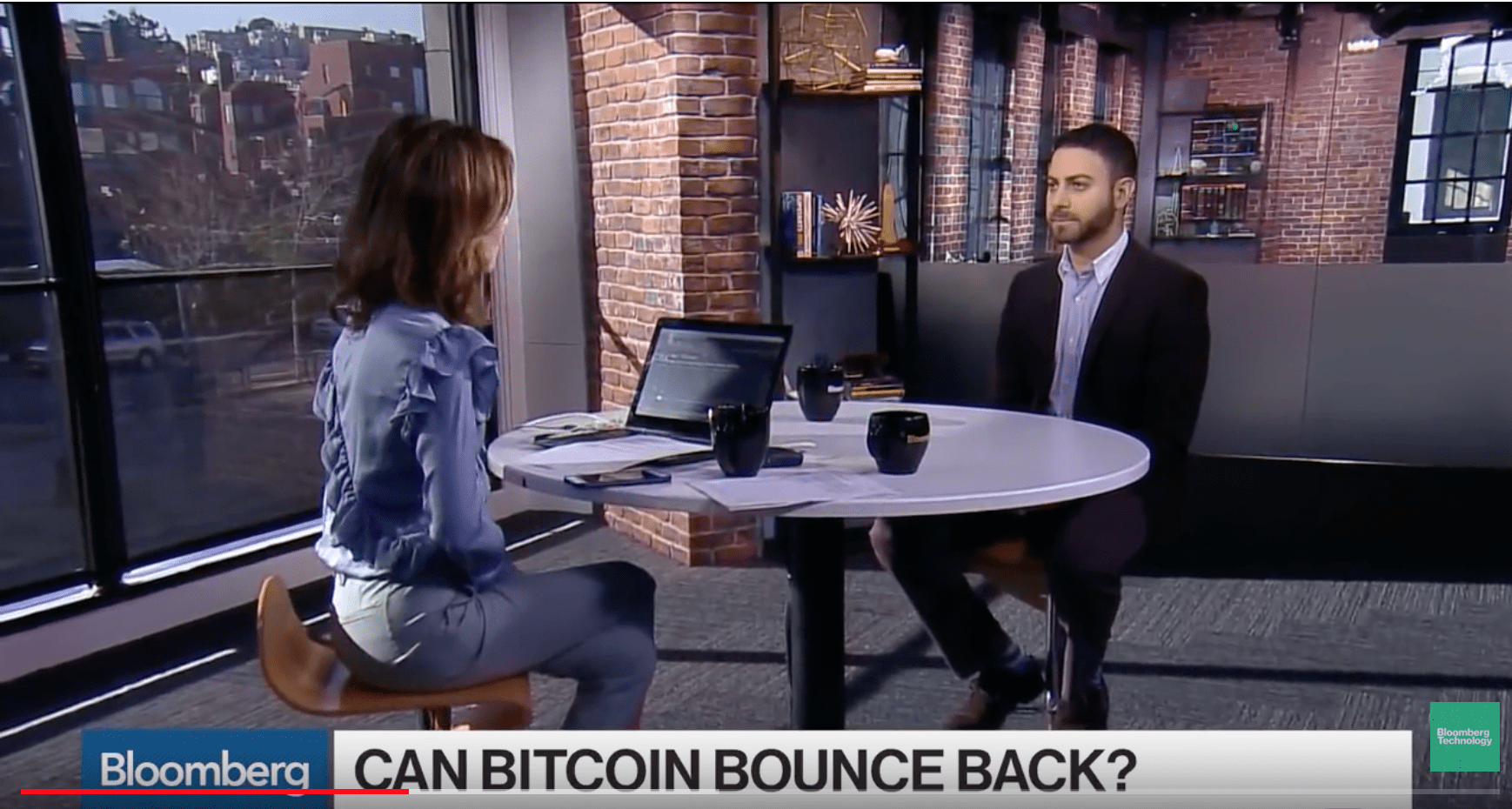

Joe DiPasquale, CEO of Bitbull Capital, shares thoughts with Jill Malandrino on the recent market volatility — and how hedge funds profit from it — on NASDAQ trade talks.

Joe DiPasquale discusses factors that influenced the price drop in Bitcoin and crypto in general on Bloomberg.

Our active involvement and relationships in the space open us up to amazing early-stage opportunities which our members get to benefit from. Through the crypto winter – in November and December of 2018, Bitcoin was down 35%, while BitBull’s Opportunistic Fund (“BitBull”) returned +29%. Learn more about how we outperform the bear market which negatively impacted the entire crypto space?

DURING THE CRYPTO WINTER

FREQUENTLY ASKED QUESTIONS

Does BitBull accept non-US investors?

What is an Accredited Investor?

Can I invest through an IRA?

How can I see the performance of my investment?

How do I make an additional investment, after I’ve already made an initial one?

Do you accept in-kind (e.g. investments in bitcoin instead of dollars)?

Disclaimer

Performance information is provided for informational purposes only. Past performance of the management team is not necessarily indicative of future results, and there can be no assurance that any projections, targets or estimates of future performance will be realized. Actual performance of the Fund may vary substantially from the performance provided on this Website. An investor may lose all or a substantial part of its investment in the Fund. Careful consideration should be given to any performance data provided herein. Fund returns are calculated net of expenses. Investments are subject to fees that includes the management fee, custody charges for holding the fund’s assets charged by the custodian, and customary fees and expenses of the fund administrator and auditor.

The performance of the Fund will be reduced by any and all applicable fees or expenses charged to and by the Fund, which could be more than the fees and expenses incurred with respect to investments held by the Manager. Performance returns of the Fund may be materially less than that of the Manager.

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS