Stablecoins may not be the sexiest infrastructure component within the cryptocurrency market, but this does not prevent them from presenting a world of opportunities, especially for sophisticated investors interested in entering the crypto space.

Our Yield Fund here at BitBull Capital enables our clients to leverage stablecoins for generous yields while also minimizing investor exposure to crypto market volatility. In this post, we’ll explore just what stablecoins are, the differences between some of the top stablecoins, and some of the latest developments and data surrounding them, particularly from the institutional investors’ perspective.

First off, let’s establish a solid foundation for just what stablecoins are.

What are stablecoins?

Stablecoins, essentially, are digital currencies that are designed to remain pegged to some external reference. Many stablecoins are pegged to fiat currencies, the most prevalent fiat currency used being the US dollar, while some stablecoins are backed by a reserve composed of one or more cryptocurrencies, or even commodities. As well, other stablecoins are designed to be algorithmically-backed, and do not have any reference to collateral. They are often referred to as non-collateralized stablecoins.

Among other uses, stablecoins are often utilized by crypto market participants to store and transfer value without the need for exiting the realm of digital currencies or exposing value to crypto market volatility.

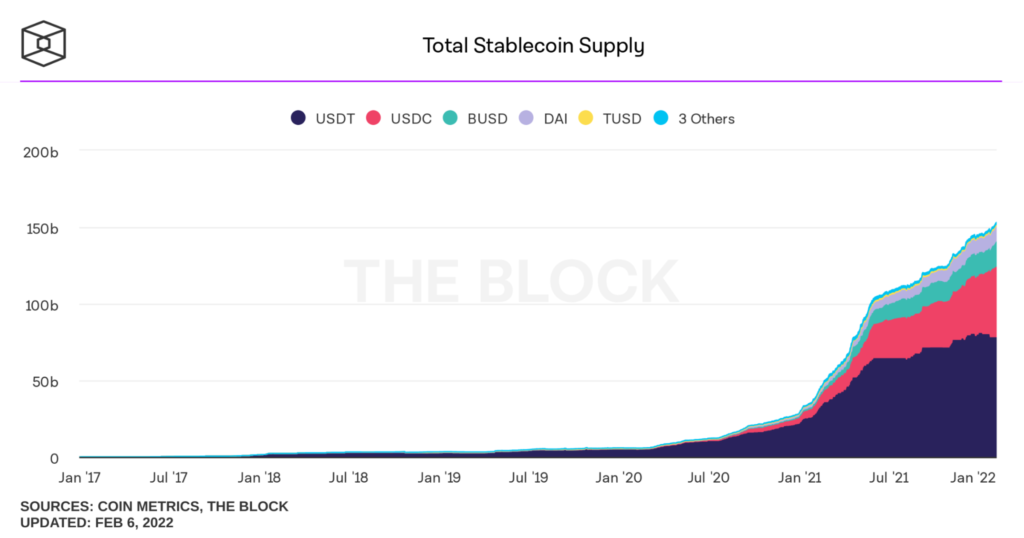

The top 5 stablecoins according to market capitalization, at the time of this writing, are as follows: Tether (USDT) at nearly $78 Billion; USD coin (USDC) at nearly $51.4 Billion; Binance USD (BUSD) at nearly $17 Billion; Terra USD (UST) at nearly $11.3 Billion; and Dai (DAI) at nearly $10 Billion.

What are some differences between the top stablecoins?

In addition to differences in how stablecoins can be designed (asset-backed vs. algorithmically-backed, for instance), there do exist differences in how stablecoins are leveraged in the cryptocurrency market.

With respect to Tether (USDT), for example, according to CryptoCompare (a global cryptocurrency market data provider), Bitcoin (BTC) to Tether trading continues to serve as the majority of BTC traded into fiat or stablecoin currencies. In February 2021, 57% of all BTC trading was done in USDT.

If one focuses the light on decentralized finance (DeFi) specifically, then USDC becomes most relevant, with USDC recently overtaking USDT on the Ethereum blockchain (where the majority of DeFi lives) with respect to total supply, according to Etherscan. Individuals interested in decentralized lending, yield farming and staking largely perform transactions using stablecoins. It appears that as DeFi has grown, so has the usage of USDC, which was founded by CENTRE, a joint venture between Coinbase and Circle.

Some stablecoins have a strong relationship to other ecosystems not named Ethereum, with one example being Terra USD (UST), created by Korea-based Terra. UST was one of the fastest-growing stablecoins in 2021. Unlike USDT and USDC, Terra USD is a decentralized and algorithmic stablecoin pegged to the US dollar and connected to the native token of the Terra public blockchain, LUNA, by way of a burning mechanism.

Essentially, whenever UST is minted (or printed) LUNA is burned, and as the demand for UST has increased, more LUNA has been burned, with more than $2.7 Billion USD worth of LUNA tokens burned in December 2021 alone.

These 3 examples reveal some of the differences that can exist between stablecoins.

How are sophisticated / institutional investors leveraging stablecoins?

There are four ways in which sophisticated and/or institutional investors have been leveraging stablecoins:

- Treasury Management

Stablecoins can be sent nearly anywhere in the world, and corporate treasuries can benefit from the blockchain-based payment routes. Moreover, although holding Bitcoin has been included in corporate treasury strategies, the volatility of BTC can be too much for some. This is where stablecoin assets can come into play.

Stablecoins have even been used by the United States government to send aid.

- Lending

For those interested — and positioned — to deploy the capital, lending is one area that is becoming of significant interest to sophisticated and institutional investors. Depositors of stablecoins into DeFi lending products can earn yield, often at a rate much higher than traditional banks.

- Yield Farming

Also referred to as liquidity mining in some instances, stablecoins are used in the yield farming context to earn yield by strategically utilizing the composability of smart contracts to disperse funds among numerous DeFi protocols. By utilizing stablecoins and not digital assets that could experience volatile price swings, investors can avoid impermanent loss as well, for example.

- Trading

In the most practical sense, stablecoins are highly useful to institutional investors with respect to trading, whether it be for on-ramps to enter – or off-ramps to exit – the cryptocurrency market. Stablecoin pairs are also more widely available within the crypto space, as regulatory restrictions limit pairings with fiat currencies. Moreover, arbitrage opportunities exist with stablecoins of which investors – and funds – can take advantage.

What are the latest regulatory developments regarding stablecoins?

In July 2021, Federal Reserve Chairman Jerome Powell, before the U.S. House of Representatives Financial Committee, said:

“We have a pretty strong regulatory framework around bank deposits, for example, or money market funds…that doesn’t exist currently for stablecoins, and if they’re going to be a significant part of the payments universe – which we don’t think crypto assets will be but stablecoins might be – then we need an appropriate regulatory framework.”

Because of the ease with which individuals can trade fiat for stablecoin currencies while also having a very high-level of certainty for maintaining the value of that stablecoin, it’s stablecoins which have been the subject of conversation largely when digital currency regulation comes up.

One ought not be surprised if the United States begins regulating stablecoins in 2022, actually.

President Joe Biden’s Working Group on Financial Markets issued a stablecoin report in November 2021. When discussing the risks associated with stablecoins, issues such as market manipulation, frontrunning, insider trading and a lack of trader transparency were mentioned.

Because of the usefulness of stablecoins within the cryptocurrency space as well as within the world-at-large, it appears that some governing bodies are most interested in stronger regulations for stablecoins, as well as seeing the massive growth in the usage of stablecoins as potentially adequate evidence for the creation of central bank digital currencies, or CBDCs.

While some may see greater regulations as contrary to the ethos of decentralization and decentralized economies in general, developments such as these could prove favorable for institutional / sophisticated investors and corporate treasuries.

What’s the growth outlook for stablecoins?

This, understandably, is difficult to tell. Perhaps as decentralized finance expands further alongside increased interoperability, the increased usage of stablecoins will follow.

The rapid increase in DeFi infrastructure tailor-made for institutional investors whereby investor capital is handled in institutional-grade secure, custodial and regulatory-compliant manners, is paving the way for effective entrance of sophisticated investors into the cryptocurrency market; this coupled with the usage of stablecoins that can earn yield with much less risk of losing intrinsic value.

There is evidence which suggests that stablecoin presence within the crypto market is strengthening the U.S. dollar’s hold as the world’s reserve currency.

Moreover, as more traditional companies integrate web3 components within their business models – i.e. non-fungible token issuance (NFTs) – the preference for stablecoin payments could also rise as well, serving as a bridge of sorts between web2 businesses and web3 infrastructure.

What’s clear regardless, however, is that stablecoins are a significant component of the decentralized economy, and there exists a wide array of opportunities for various levels of risk-tolerance.

Our new Yield Fund here at BitBull Capital is designed to help corporate treasuries or simply those who do not want to take on the risk of volatile crypto assets to earn yield from assets tied to the US dollar. It’s with respect to the Yield Fund that our experience privately investing corporate treasury cash with solid returns, utilizing USDC, is most useful.

To learn more about Yield Fund, book a free call here.