This is another part of our new series, “Crypto Hedge Fund Trading Strategies”, where we share insights from the crypto investing and trading space. As a pioneering crypto fund of funds, BitBull Capital has had the opportunity to conduct diligence on most of the 600+ crypto hedge funds and their strategies. When choosing strategies for our own fund, we prioritize those which have the best chance of performing positively in the long run and this series presents a simplified view of the same.

While our crypto trading strategies are a balance between equity investments, futures, pre-ICO/STO, volatility trading, and others, in this article we will discuss arbitrage trading, one of our market-neutral strategies.

What is an arbitrage trading strategy?

Arbitrage is a market-neutral trading strategy which exploits price inefficiencies between different markets. It is market-neutral because it does not depend on prices moving in any set direction, and works in both bull and bear markets. The key here is to identify price differentials and to profit from them in a short time they exist. However, given how some of the top exchanges, such as Binance, OKEx, Bittrex, and Bit-Z have several hundred markets each (448, 422, 323 and 163 respectively), it becomes tricky choosing the best pairs and identifying minor inefficiencies.

An example of this is where one exchange may have the BTC/USD pair trading at $3,600 and another BTC/USD market has a price of $3,650 – a $50 difference. This creates an opportunity to buy BTC from the first exchange and then sell it on the second to record a $50 profit per BTC.

While the $50 profit may not seem significant, the short duration of this trade and proper risk management ensures quick, consistent profits with a very low downside. When done with a decent amount of capital, the gains can quickly add up, making arbitrage a valuable strategy in any portfolio.

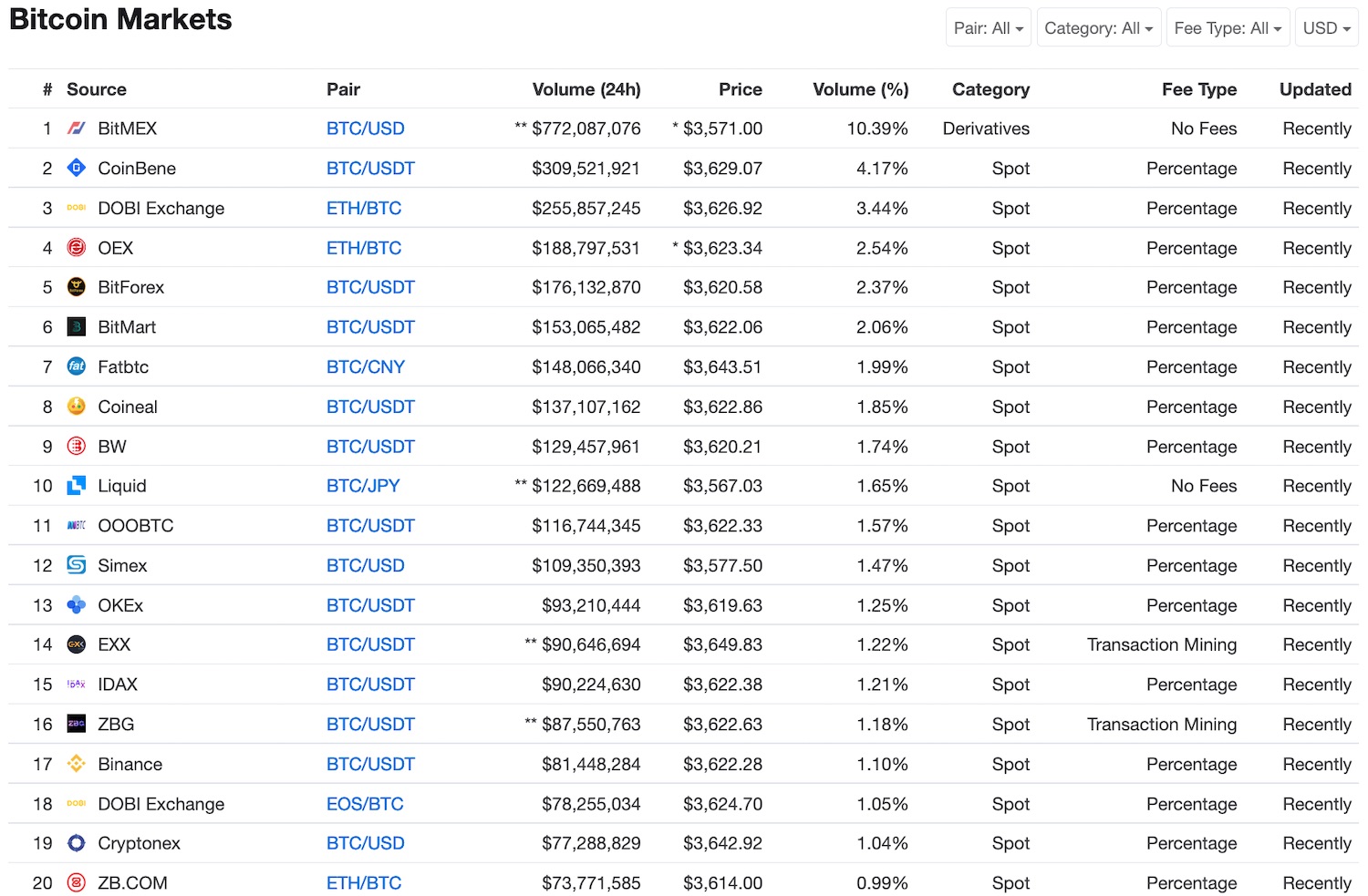

The chart below, courtesy CMC, shows an example of the price differences which exist between different BTC markets at any given time.

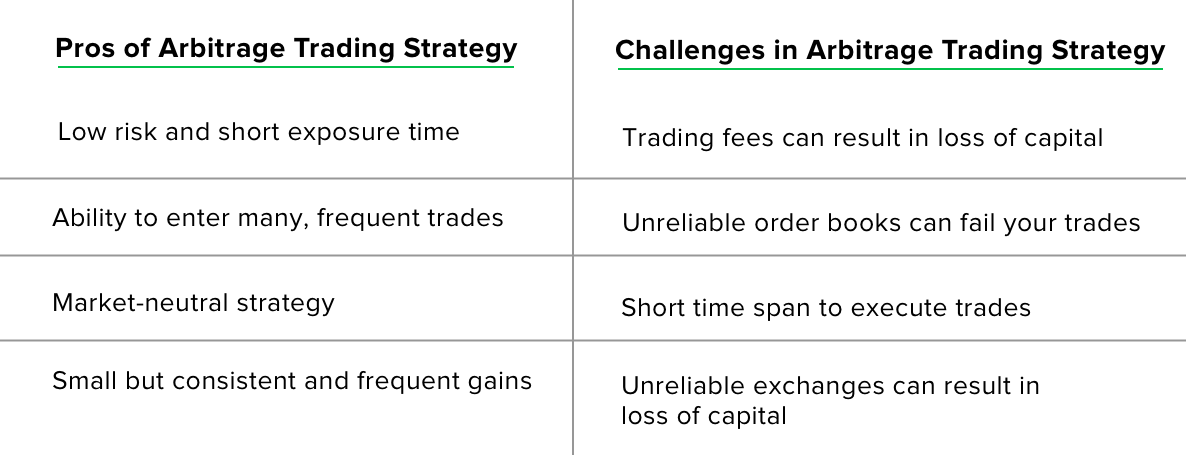

Arbitrage trading is not without risks

Even though the concept behind arbitrage trading is simple, this strategy, like any other, has inherent risks which should be addressed.

Firstly, in the case of cryptocurrencies, volatility is usually very high, and price differentials do not often remain open for long durations. The trading window for arbitrage is usually very small, and successful trades depend on timely execution. Additionally, the time required to confirm transactions between two markets and the amount of fees paid to expedite them is also a consideration.

Secondly, there is always a risk involved when dealing in local currencies in certain cases. For instance, during bullish times and amidst high demand, the “Kimchi premium” has presented a very lucrative opportunity for arbitrage, where high demand in South Korea resulted in Bitcoin prices (in KRW) being up to 20% higher than international markets. However, it involved selling Bitcoin for KRW and then converting it to USD. Similarly, in Zimbabwe and other countries affected by hyperinflation, Bitcoin has sold at premiums of up to 60%, but traders must calculate the risk of dealing in very unstable local currencies.

Thirdly, there is a risk of slippage, which occurs when traders do not account for extra fees, including transactions fees, and more importantly, trading fees. If not managed properly, you can easily erode all potential profits if you do not account for fees that accompany every single deposit, trade, and withdrawal.

Fourthly, given how unreliable crypto exchanges can be, there is a risk that the market you wish to buy from or sell on may experience heavy load, may suspend deposits or withdrawals, or may not even have sufficient order book depth to satisfy large trades. Jumping in without considering these risks can result in loss of opportunity as well as funds in some cases.

How does BitBull Capital profit from arbitrage trading?

Arbitrage trading is just one of the many trading strategies we leverage at BitBull Capital, as part of our active crypto fund management. Even though arbitrage is not aimed at quick, massive profits, as is the case with high-risk opportunities like pre-ICO investments, it balances out a healthy portfolio by providing a relatively low-risk avenue for consistent gains.

In the future, we will be sharing more crypto trading strategies used by crypto hedge funds. Meanwhile, you can read more of our crypto research on our website and contact us with inquiries about joining our crypto hedge fund.

BitBull Capital GP, LLC (“GP”) and BitBull Capital Management, LLC (“IM”) are, respectively, the general partner and investment manager of funds including the BitBull Fund and BitBull Opportunistic Fund (collectively, “BitBull”). The GP and IM are not registered investment advisers with the Securities and Exchange Commission or any state’s securities commission. The limited partnership interests (the “Interests”) in the Fund are offered under a separate confidential private placement memorandum (the “Private Placement Memorandum”), have not been registered under the Securities Act of 1933, as amended (the “Securities Act”), or any state securities laws, and are sold for investment only pursuant to an exemption from registration with the SEC and in compliance with any applicable state or other securities laws. Interests are subject to restrictions on transferability and resale and may not be transferred or resold except as permitted under the Securities Act and applicable state securities laws. Investors should be aware that they could be required to bear the financial risks of this investment for an indefinite period of time. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. Certain information contained on this site may constitute “forward-looking statements” which can be identified by use of forward-looking terminology such as “may,” “will,” “target,” “should,” “expect,” “attempt,” “anticipate,” “project,” “estimate,” “intend,” “seek,” “continue,” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to the various risks and uncertainties, actual events or results in the actual performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements. The GP is the source for all graphs and charts unless otherwise noted.