Welcome to our new series, “Crypto Hedge Fund Trading Strategies”. As the first crypto fund of funds, BitBull Capital has the benefit of doing diligence on hundreds of the 600+ crypto hedge funds and their many strategies. We’re often asked questions about these strategies, whether it’s directional strategies like ICO investing, or market-neutral strategies like arbitrage investing. It’s our job to choose which of these funds we believe will perform best in the long run; we’ve invested in 10, which investors in our Fund of Funds get access to (see our article about investor meetups from a couple of our 10 funds here).

Although we leverage different strategies based on market conditions, this is a simplification of the strategies of the 10 funds we are investors in. Some strategies our funds pursue are, for example, equity investments, CTA/systematic, futures, shorting, and market making. Our intention with these articles is to give clarity to investors on what strategies crypto hedge funds are using.

Why start with Volatility? Our new fund, BitBull Opportunistic, leverages the diligence we do with our Fund of Funds, where we rebalance monthly and attempt to focus on what funds and strategies we believe will do best given the current times. With BitBull Opportunistic, the intention of the fund is to solely focus on the best strategies in that particular time period. We believe Volatility funds will return the best results in this current market, so our Opportunistic fund is currently pursuing that strategy, and this article is an attempt to elucidate that strategy further.

What is the volatility trading strategy?

Volatility trading gained headlines as one of the best-performing hedge fund strategies of the last financial crisis. Given crypto’s own current crash, volatility is a strategy that we believe will outperform in this moment.

Although volatility traders in other markets will use options to trade in various ways, the emerging crypto asset class both gives fewer opportunities (lack of reputable counterparties for shorting, for example) and more (some more obvious opportunities in the assets themselves). So, this article will be focused less on straddles, strangles, butterfly spreads, and Iron Condors, and more on a bird’s eye view of volatility plays easily accessible in crypto.

Volatility trading strategy, as the name suggests, focuses on making the most of up and down price changes by playing on volume of trades rather than waiting for a big move. The volatility inherent in crypto markets presents an amazing opportunity for this strategy, allowing savvy managers to consistently make quick profits with relatively low-risk, short-term trades.

A simple example of volatility is where Bitcoin, which has been trading in the $4,000 – $4,200 range recently, drops around the $3,700 level and heads for the nearest support. This presents an opportunity to long Bitcoin at a strong support level, with the aim of profiting when it closes in on the next major resistance level.

The chart below (4-hour scale) shows Bitcoin throughout most of December and we can clearly see the volatility and price movements, all of which presented opportunities for volatility trading.

BTC/USD chart – source: Bittrex

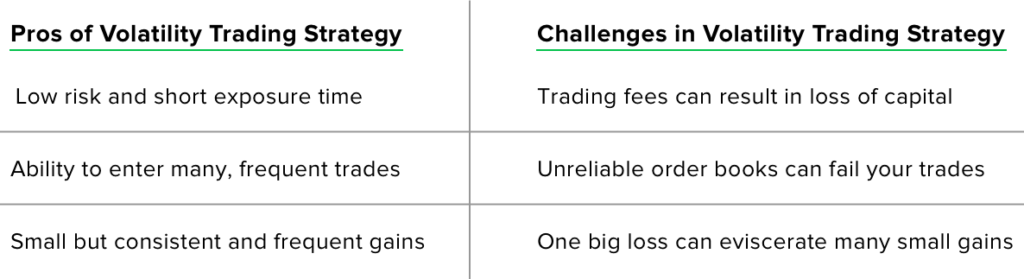

Typically, an asset such as Bitcoin trades in a narrow range during a bear market, and with proper risk management, and choosing the right time-scale, we can continue to profit from these price movements. However, just like there are pros to the volatility trading strategy, there are challenges as well – including slippage due to trading fees, the unreliability of order books on most retail exchanges and the need for prudent risk management.

How does BitBull Capital Profit from Volatility Trading?

Volatility is just one of the trading strategies we employ as part of our active crypto fund management, and while it is not a strategy geared towards massive profits such as the more-risk pre-ICO investments, it allows small but consistent gains which add up each time, particularly in a bear market such as this.

In the future we will be sharing more crypto trading strategies, meanwhile, you can read more of our research on our website, bitbullcapital.com and contact us with any questions you may have or inquiries about joining our crypto hedge fund. Below you will also find some reference charts which show varying levels of volatility among the top cryptocurrencies.

Charts and graphs in this article are from HitBTC and Bittrex

BitBull Capital GP, LLC (“GP”) and BitBull Capital Management, LLC (“IM”) are, respectively, the general partner and investment manager of funds including the BitBull Fund and BitBull Opportunistic Fund (collectively, “BitBull”). The GP and IM are not registered investment advisers with the Securities and Exchange Commission or any state’s securities commission. The limited partnership interests (the “Interests”) in the Fund are offered under a separate confidential private placement memorandum (the “Private Placement Memorandum”), have not been registered under the Securities Act of 1933, as amended (the “Securities Act”), or any state securities laws, and are sold for investment only pursuant to an exemption from registration with the SEC and in compliance with any applicable state or other securities laws. Interests are subject to restrictions on transferability and resale and may not be transferred or resold except as permitted under the Securities Act and applicable state securities laws. Investors should be aware that they could be required to bear the financial risks of this investment for an indefinite period of time. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. Certain information contained on this site may constitute “forward-looking statements” which can be identified by use of forward-looking terminology such as “may,” “will,” “target,” “should,” “expect,” “attempt,” “anticipate,” “project,” “estimate,” “intend,” “seek,” “continue,” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to the various risks and uncertainties, actual events or results in the actual performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements. The GP is the source for all graphs and charts, unless otherwise noted.