Safe-haven assets like gold appreciate in response to global conflicts and tensions, but Bitcoin was not seriously considered such an asset until the latest US-Iran tensions highlighted an interesting price trend.

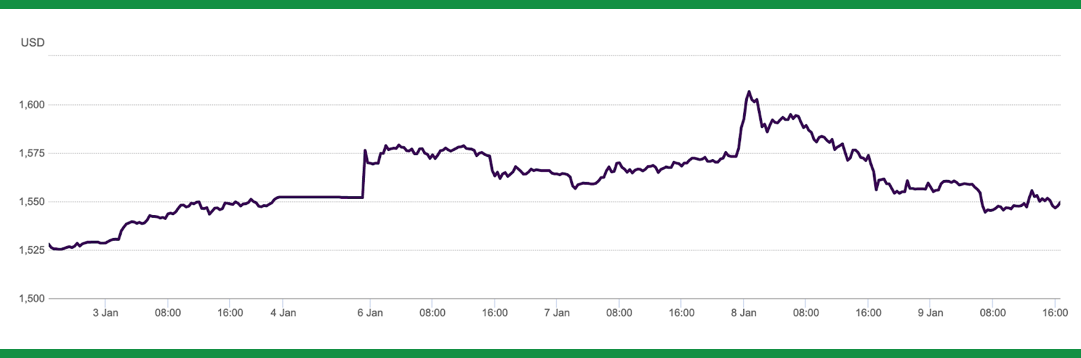

On January 3, 2020, when a US drone strike killed a top Iranian general, it was feared that the incident would spark a major conflict, possibly resulting in another war. Gold appreciated from $1,525/oz and Bitcoin followed the same trend.

Gold chart (USD/oz)

BTC chart (USD/BTC)

While the rise in gold prices was decent, taking it as high as $1,600/oz, a price not seen since early 2013, Bitcoin appreciated over 23%, going from around $6,850 on January 3, to $8,450 by January 8, 2020.

Now, with the latest developments hinting towards de-escalation between the US and Iran, prices of both, gold and Bitcoin, have started retreating.

Given how Bitcoin had long been called digital gold, and a store of value, this latest price action is very interesting and indicates growing confidence in the digital currency, which ended 2019 as the best investment of the decade.

With Bitcoin’s growing relevance in the global economy, we reiterate our long-term bullish stance on the digital currency, which continues to prove why many forward-looking investors are gaining exposure to digital assets.