The market cycle is a naturally occurring phenomenon, attributable to human psychology, and has repeated itself time and time again, though with some variations, in the lives of nearly all market traded instruments.

In his book The Intelligent Investor, Benjamin Graham describes the market as fluctuating between irrational exuberance and unjustifiable pessimism, much like a pendulum. It is never quite rational, and smart investors and traders make their money during these swings.

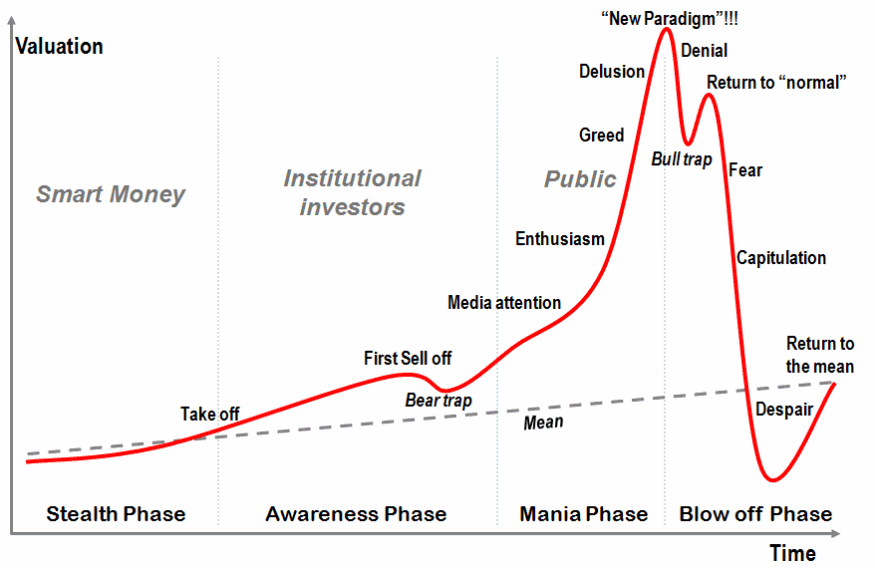

Interestingly, the stages of a bubble highlighted in the market cycle chart attributable to Jean-Paul Rodrigue (shown below), exhibit this very behavior and map fairly well on most instruments, including Bitcoin, the leading digital currency.

In this article, we take a quick look at Bitcoin’s market cycle, which shows how the last few months have presented a great opportunity for buying it.

The chart above shows the various stages of a bubble during a typical market cycle. An instrument takes off from the stealth phase, where not many people are talking about it and the only smart money is entering. As it picks up, institutional investors with access to good deals make their entries. By the time mass media and public awareness come into the picture, the instrument enters the mania stage and explodes to unprecedented heights. This parabolic surge is followed by smart money profiting and exiting, as the cycle turns bearish and finally capitulates to the point of despair.

After moving through the stage of despair for a while, the market recovers to the mean and the entire cycle repeats itself (as long as overall fundamentals remain unchanged).

This cycle repeats itself to varying degrees but is fairly accurate in representing the shift between market sentiments of euphoria and pessimism, and an acknowledgment of this natural phenomenon is key to profiting from any traded instrument, including Bitcoin.

Mapping Bitcoin’s market cycle

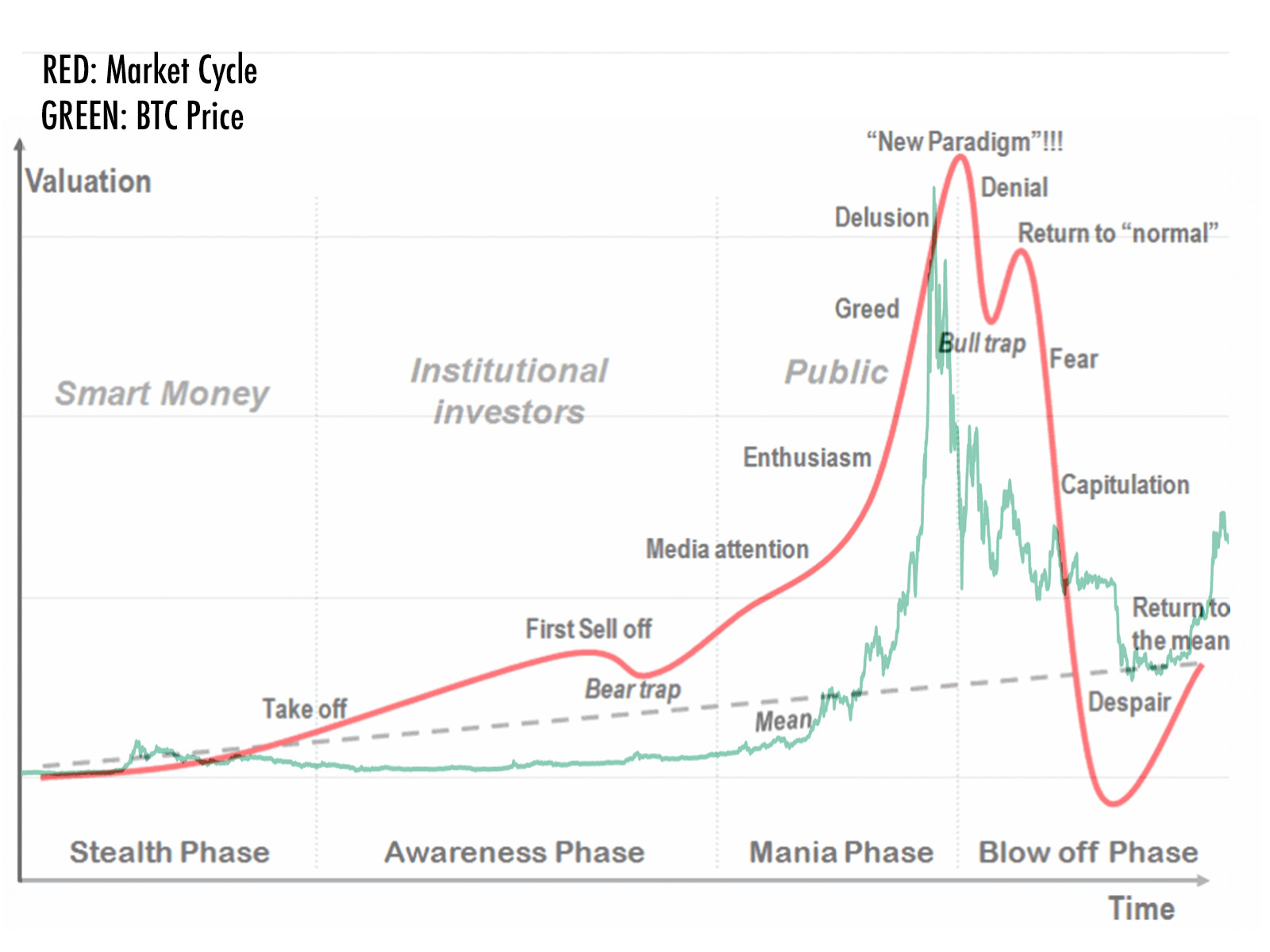

The diagram above overlays Bitcoin’s life-time price chart over the market cycle chart and reflects, fairly accurately, Bitcoin’s accumulation during the stealth phase to the irrational exuberance followed by capitulation and despair.

Even at a micro-level, we can breakdown Bitcoin’s price movements into smaller cycles, where each instance of parabolic growth reflects a repeat of the entire market cycle. However, looking at the big picture, we can see that Bitcoin’s price from late November 2018 to late March 2019 presented excellent opportunities for entry.

Where are we presently?

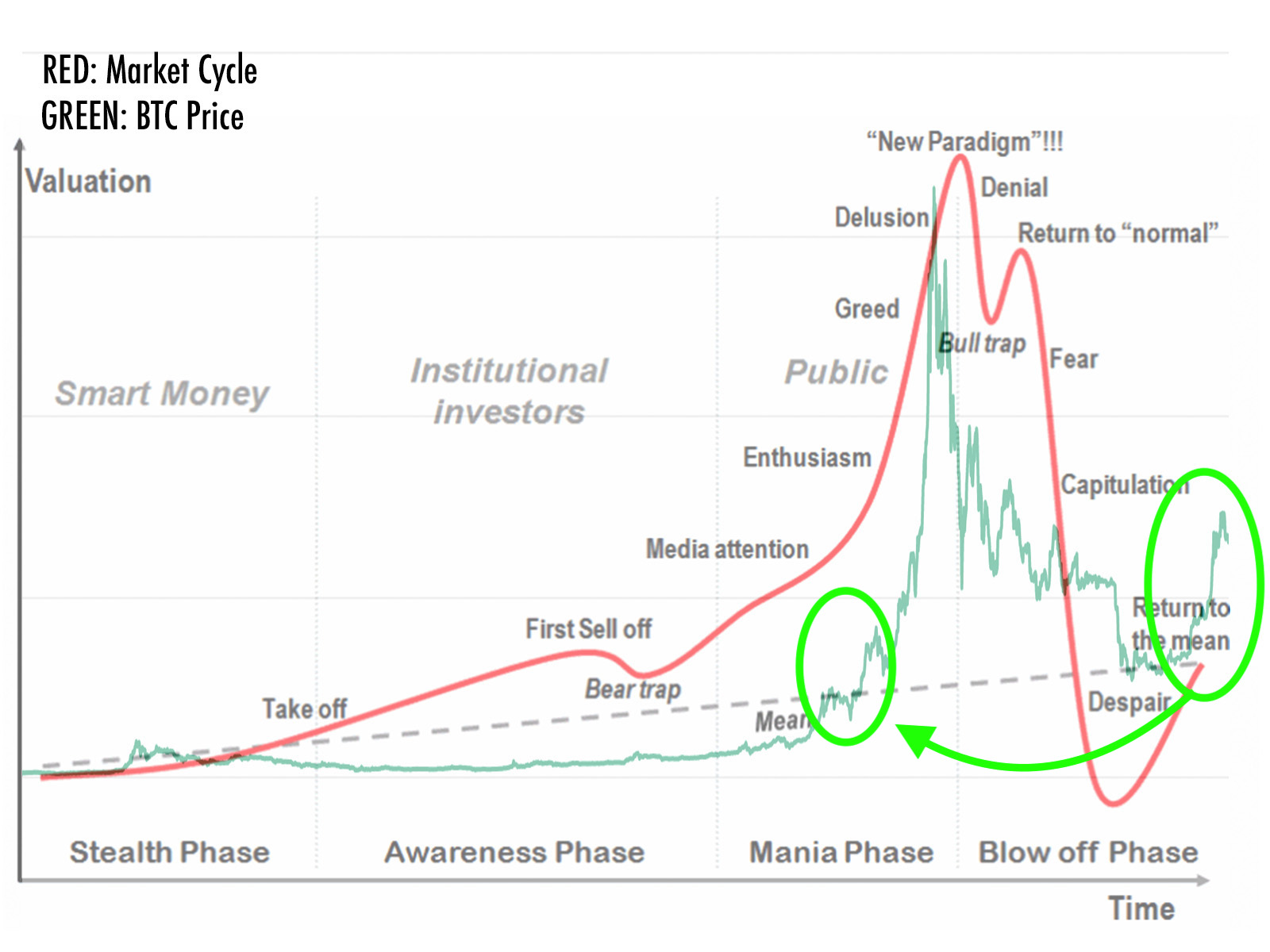

At present we are near the upside following the despair stage, where positive interest is returning and institutional investors are making their entries (assuming smart money entered during the lows of despair).

The chart above shows how the current Bitcoin price can be related to an earlier stage in the cycle. Moving forward we can expect sell-offs and bear traps as accumulation continues, and as new developments and positive media attention increases, the price is likely to be propelled towards parabolic growth.

Will we see parabolic growth again?

To answer this question, we need to identify the factors behind parabolic growth. Typically, the mania phase is a result of widespread awareness coupled with a fear of missing out. As Bitcoin’s price movements drew media attention in 2017, more and more people entered the market, and the resulting price increase further cemented the enthusiasm until it reached unsustainable levels, fueled by irrational optimism.

Will this happen again? Historical trends suggest that the probability for another parabolic move is high, provided that the fundamentals behind Bitcoin remain unchanged. Interestingly, the fundamentals in Bitcoin’s case not only remain unchanged but grow stronger as institutional investors, governments, financial industry stakeholders and regulators recognize its potential and pave the way for further adoption and development.

Moreover, in the case of traditional instruments and commodities, such as gold, a significant portion of their potential has been recognized, appreciated and priced in. However, cryptocurrencies, as a new asset class, are still in their nascent stage, and putting a cap on their price appreciation or even predicting future action is much more difficult in the face of unknown factors.

Finally, to put it succinctly – while Bitcoin price could move anywhere, including 0, the reasons above may lead it to make another parabolic move and rise even higher than the last cycle.