On the morning of December 6th, 2017, Bitcoin opened at $11,590 USD. At its peak during the day, it reached an all-time high of $14,530 for a total variance of $2,940. By midday December 7th, it had shattered the $15,000 and $16,000 marks and is presently sitting at $16.361. At this rate, it’ll probably break $17,000 before I can click “publish” on this article.

Let that sink in for a minute. That’s 41% growth over the course of around 36 hours. To put that in perspective, prior to November, 2017, Bitcoin had never seen an intraday growth greater than $1,000. To go back even farther, before January, 2017, Bitcoin hadn’t seen a spot price greater than $1,000 since mid-December of 2013.

On the year, Bitcoin has seen total growth of 1,531%. In comparison, the price of physical gold has seen year-to-date growth of just under 9%.

To say that Bitcoin has exceeded expectations would be a grievous understatement. Looking back on the major financial headlines over the past year proves my point. Here’s one of my favorites from this time last year:

“Bitcoin predicted to rise 165% to $2,000 in 2017” — CNBC, 12/7/2016

And to think that this projection was bullish at one point!

But what is causing this latest, greatest round of explosive growth? Two words: Bitcoin futures.

For a brief recap:

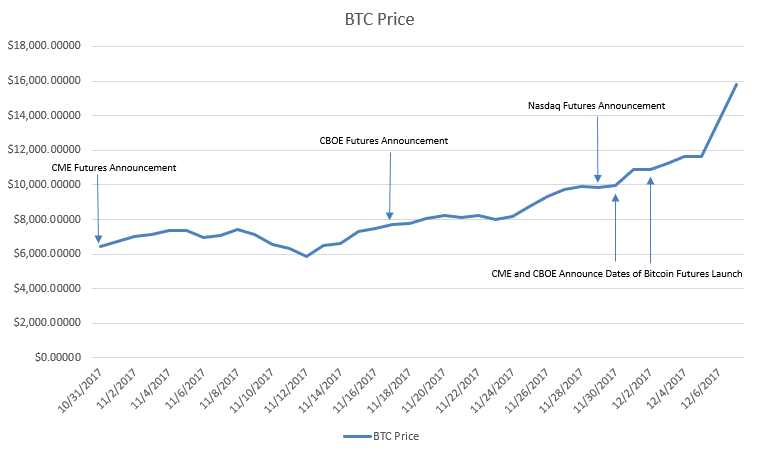

· October 31st: CME announced they would be launching Bitcoin futures by year end, “pending regulatory review”

· November 17th: CBOE announced their official contract specs for their Bitcoin futures offering

· November 29th: Nasdaq announced their intention to launch Bitcoin futures in early 2018

· December 1st: CME announced they will launch their Bitcoin derivatives product on December 18th

· December 3rd: CBOE announced they will launch their Bitcoin derivatives product on December 10th

With each of these announcements, the price of Bitcoin has spiked, pulled back slightly — likely due to early investors cashing in on a hefty return — and then continued to climb steadily upwards. Below is a chart of Bitcoin’s activity since the end of October, with these key events indicated.

While the unprecedented dollar increase in the price of Bitcoin over past 36 hours can’t be directly attributed to any one event, it makes sense for the price to continue this upwards trajectory coming in to the first futures launch on December 10th. Nobody wants to be left out.

The lasting effect that Bitcoin futures will have on the price remains to be seen; however, it’s quite possible that this could be the lowest price tag we will ever see for Bitcoin moving forward. If you just scoffed internally, let me remind you that during this same calendar year, we were celebrating the “breakout” above $1,000 — and that was without announcements from major players in the financial industry that they’ll be bringing Bitcoin to the institutional masses, or the governments approval to do so.

For those of you feeling like it’s too late to join the party, I have good news: here is your official invitation. Folks thought that it was “too late” when Bitcoin broke the $1,000 mark as well. In fact, I’d wager that for everyone milestone Bitcoin has achieved, there are entire populations around the globe kicking themselves and saying, “I missed it.” Oh, how very wrong they are.

The ceiling for Bitcoin’s value is impossible to establish at this point. Every time the brightest minds in the finance industry attempt to put a lid on it, it shatters expectations once again, and takes its proponents and investors higher in to the stratosphere.

There’s no telling where this flight will level out, but one thing is certain: you don’t want to miss the plane. Whether you invest directly, or via a more risk-adjusted method (such as our very own BitBull Fund of Funds), it’s no longer a debate: we are witnessing once in a lifetime opportunity, as history unfolds before our very eyes.

Choose your role: spectator or participant.