The real estate market represents one of the oldest and most significant investment classes. Real estate investments yield competitive returns and are particularly effective hedges against inflation, however, there have been several persistent barriers to entry, including the high cost of entry and low liquidity.

With digital currencies emerging as a new asset class, their underlying technology – blockchain networks – have evolved to not only serve transactional systems but also confer, hold and transfer value in general.

As the industry and technology continue to develop, there is considerable room in merging the old with the new, and few areas hold potential equal to the tokenization of real estate.

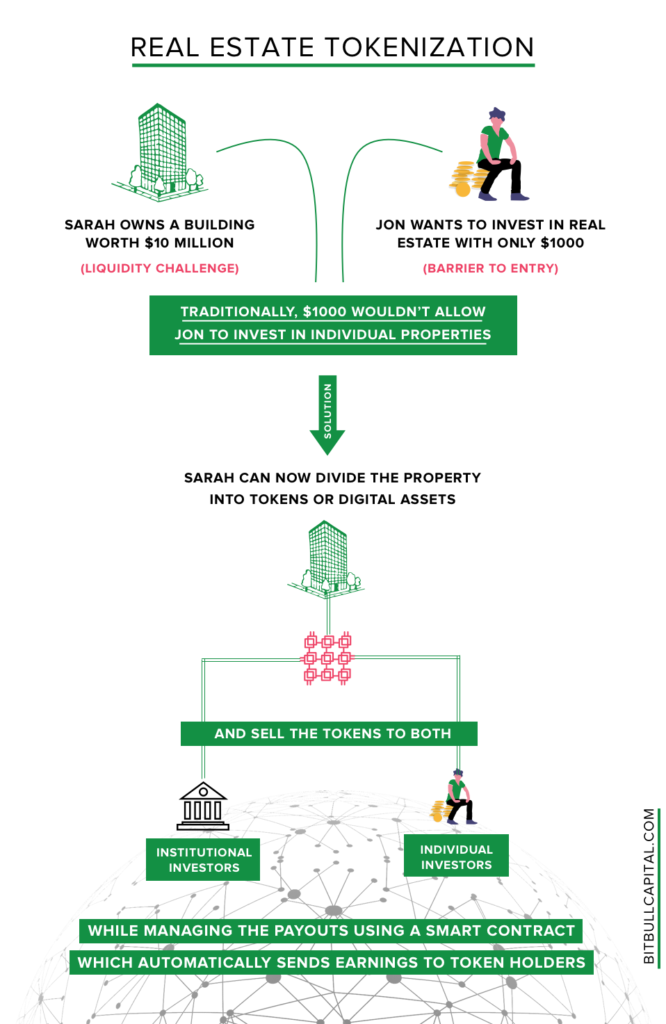

Tokenization, as the name suggests, is the representation of an asset or equity, in token equivalents, which can be fractionally divided and owned.

A tokenized property would be akin to a real estate investment trust (REIT), but much more flexible and with very little middlemen fees.

Unparalleled liquidity

Tokenized equities and real estate will witness unparalleled liquidity, given how the ease and secure settlement of cross-border transfers in tokens can take investment pools truly global.

Fractional ownership/Low cost of entry

Since tokens support fractional ownership, they considerably lower the cost of entry, further opening up the investor pool and unlocking developing regions and economies around the world.

Efficient administration/No middlemen

Tokenized securities can be further programmed for efficient administration – this is done via the use of smart contracts, which can easily send out dividends and support other functions, such as voting rights. Moreover, since all of these activities are recorded on the blockchain, management overheads are significantly reduced, middlemen are removed from the picture and costs are lowered for both investors and issuers.

Increased transparency

Not only are blockchain networks secure, but they are also immutable and allow for increased transparency, where every transaction and value transfer is recorded on a ledger. Access to the ledger can be permissioned if required, and overall, blockchain implementations are flexible.

Current challenges to tokenization of real estate

While the prospect of tokenized real estate is quite attractive, its implementation is not without challenges.

First, there is a need for improved security practices and general awareness around the custody of digital tokens. Time and again, we see exchanges getting hacked and/or cryptocurrency owners losing their holdings due to security lapses as simple as phishing attacks and keyloggers.

Until institutional-grade custody solutions and exchanges become mainstream, the dream of tokenized real estate will be difficult to realize.

While there are several reputable platforms, such as Polymath and Swarm, they only take care of the technology end of tokenization. Before there can be any meaningful adoption, regulatory developments need to be made. Even when tokenized, real estate tokens fall under securities law, and compliance procedures need to be followed. Unfortunately, there is the feeling of a lack of clarity surrounding digital securities, and presently, industry stakeholders have adopted a “wait and watch” approach.

Promising ventures in the real estate space

Recognizing the potential in this space, the BitBull Fund already has exposure to promising ventures like TrustToken (which supports the tokenization of most real-world assets), and we are observing other projects such as Harbor, which supports digitization of various kinds of securities, RealBlocks, which democratizes access to alternative investments by tokenizing real estate investment funds, and Meridio, which allows property owners to liquidate their assets flexibly using smart contracts and issuing digital tokens backed by the underlying real estate.

Given the benefits of tokenizing securities (particularly the reduced buy-in price and increased liquidity in real estate), it is all but certain that the future will see a larger-scale adoption of digital securities, and it will be better for the industry that it happens when everyone is ready for it.

This is a view shared by industry pioneers, such as Perrin Quarshie of RealBlocks, who says, “I think adoption will come when blockchain projects can efficiently deliver on the value proposition that tokenization offers. Some of that will take time, but we’re beginning to see a lot of banks and other organizations recognize the intrinsic liquidity enhancements associated with tokenization.”