Since the U.S. IRS categorized Bitcoin (and other crypto assets) as property for the purposes of tax, U.S. crypto owners have had to pay capital gains tax on their cryptocurrency profits. However, there are some instances where crypto transactions fall under the income tax regime. With the 2020 tax filing deadline approaching May 17, 2021, this post includes the key particulars as well as answers to the most frequently asked questions by our investors.

Taxable events for cryptocurrency holders

U.S. crypto holders are liable for two categories of tax, capital gains, and income tax. Events that trigger capital gains include:

- Selling crypto for fiat

- Exchanging crypto for goods and services

- Exchanging one crypto asset for another

For the purposes of these events, capital gains tax is calculated based on the holding period. Gains made from crypto held for less than a year fall under the short-term tax rate, which is the same as your current income tax rate. The current brackets for income tax can be reviewed here.

In the event that you realize losses, you have the option to offset them against your income tax liabilities up to a total of $3,000, and any excess can be carried over to the next tax year.

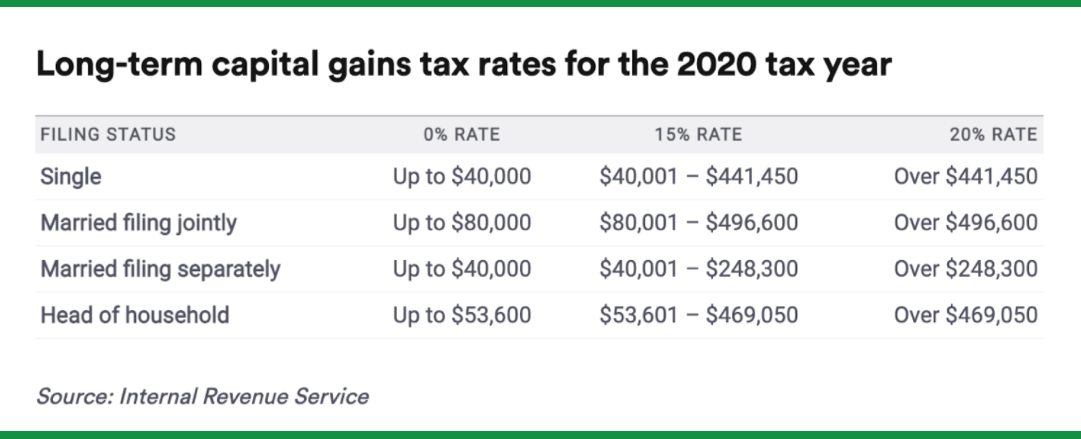

For crypto assets held longer than a year, gains are calculated based on the long-term rates, depicted in the table below.

If you realize losses from long-term holdings, you have the option to offset them against your entire capital gains liabilities, arising from other asset classes, including stocks. Any excess losses can be carried over to the next tax year.

Note: The current administration is considering changing these long-term capital gains tax rates under new reforms.

Events that trigger income tax liabilities

Even if you’re not trading crypto assets, you may be liable for income tax based on the following events.

- Receiving crypto assets via airdrops

- Earning crypto from staking, mining, or lending crypto assets

- Receiving remuneration for work in the form of crypto assets

The tax rate for these activities is the same as your ordinary income tax bracket.

FAQs from BitBull Capital investors

Q: Is the fund intended to be a mark-to-market taxpayer (i.e. “dealer” or “trader” in securities, etc.), or have flow-through earnings with those characteristics

A: No. As of 12/31/19, none of the underlying funds that BitBull invested in had mark-to-market earnings.

Q: Is phantom taxable income expected?

A: This is a pass-through entity, so often there is taxable income without any income distribution (could also have taxable losses flow through). I would expect phantom income/loss.

Q: How are unrealized gains/losses in the portfolio captured/recognized for tax purposes?

A: They are unrealized and thus not taxable until realized.

Q: Is the fund an active “trade or business” whereby the fund level expenses are intended to be ordinary deductions, or a passive investment vehicle intended to report as miscellaneous deductions (therefore non-deductible for US individuals)?

A: Some trade or business type income is passed through from the fund’s underlying investments. There were some passive losses in 2019, and there could be some passive income/loss for 2020 and beyond.

Q: What is the expectation for tax distributions to cover investor liabilities?

A: We do not make tax distributions to cover investor liabilities.

Q: What is the state and local filing footprint?

A: There was no state sourced income to date, so the only state filing is for resident partners. This could change in the future.

Q: Do you file state and local composite returns on behalf of the investors?

A: Not applicable, but if there is State Income in the future, the answer will be no.

Q: Who is your tax return and K-1 preparer?

A: Richey May & Co. (nationally ranked top 20 hedge fund auditors).

Q: Is there a section 754 election in place?

A: No, and no intention to make this election now or in the future.

Miscellaneous information

Timeline/delivery of financial reporting (Monthly/Quarterly/Yearly)

- Management financial information and/or projections: In addition to our own investments, we also invest in underlying funds. Most crypto hedge funds take 30-40 days after the end of the month to report final numbers. Since we cannot start our reporting until we have all the underlying funds reporting, we have seen an average close time of 45 days after the end of the month.

- GAAP financial information: We are currently working on the 2019 audit and expect for that to be completed by June 2021. We cannot start the audit until we have all the underlying audits.

- Tax reporting (estimates and final tax info/K-1s, etc.): Late August is our estimate, but that is due to timing of our underlying K1s, which is out of our control.

Asset valuations

Q: What is the methodology used to value the asset portfolio, and is this valuation performed in-house or outsourced to a third party?

A: Valuation is outsourced to a third-party, Trident Trust. More information can be shared upon request.

Fees

Q: Are performance fees computed on investor returns net of the management fee?

A: Yes.

Q: Is there a clawback to the manager/GP on the incentive allocation/performance fee?

A: No.

If you have any other questions about investing in Bitcoin and crypto via BitBull Capital and are an accredited investor seeking crypto exposure, schedule a call with one of our representatives.