Through BitBull Capital’s Fund of Funds, it’s our job to diligence crypto funds and invest in those we believe are well-managed and will perform for our investors.

We began investing in crypto hedge funds in 2017, and over the years have invested in 10 crypto hedge funds. Our job gives us a rare vantage point of following various funds, investment strategies, deals, and managers; we also rebalance between these funds or new funds as we gain real experience of working with them. We’re writing this guide to share some initial vetting and diligence questions, as well as learnings, with anyone seeking to invest with a cryptocurrency hedge fund.

The establishment of blockchain as an emerging, disruptive technology, and crypto as a new asset class, is attracting all types of investors to the fold, including institutional investors, endowments, and family offices. However, identifying promising opportunities and managing crypto portfolios remains challenging as the space has grown to over 2,300 different cryptocurrencies and continues to expand.

Often, investors seek active management like hedge funds and venture capital for various reasons: for example, downside protection, alternative strategies such as arbitrage, or access to exclusive deals (as with the best venture funds). Funds may provide a more convenient and secure alternative for investors seeking crypto exposure. But: how do you select a crypto fund?

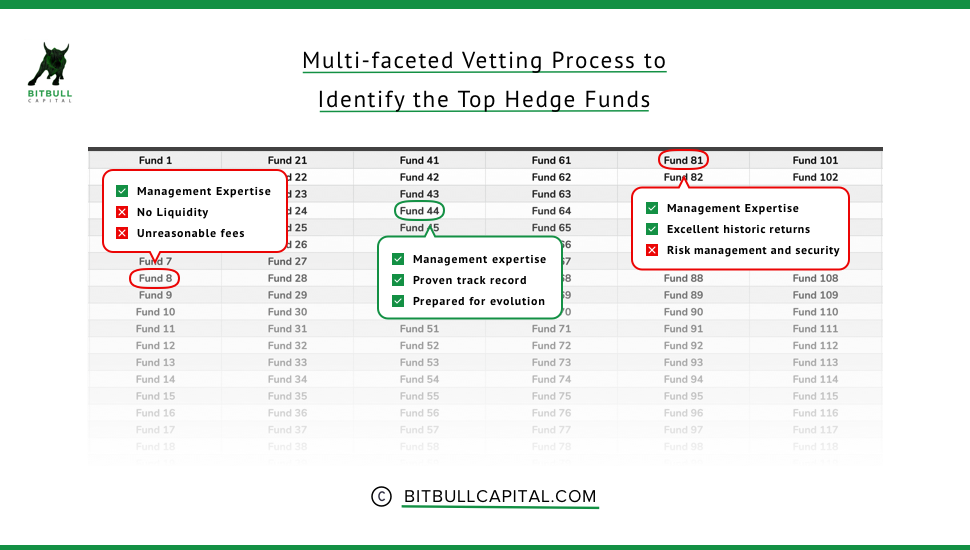

Identifying crypto hedge funds

There are over 800 different blockchain and crypto funds in operation, though not all of them advertise their services. A simple Google search will bring up a few names, but some of the most reputable funds are not legally allowed to promote themselves and remain exclusive.

A good way to learn about crypto hedge funds is through a solid network. We continually rely on leveraging our network to learn about emerging fund managers as well as gain access to the exclusive funds. We attend the calls and meetups for the funds we’re invested in, as well as general industry meetups of crypto developers, as well as hedge fund managers and investors. This is a great way to get to know the funds and their reputation.

When possible, attend industry events, meet investors and managers and get to know the landscape before making a choice.

Shortlisting based on strategies and performance

Once you’ve identified crypto hedge funds accessible via your network, you need to shortlist those which employ strategies and show performance in line with your investing goals and expectations.

For instance, some hedge funds have a mix of a venture capital and a more liquid, hedge fund approach. They may be focused solely on private deals, where the reward is typically high, but the cost of entry can be prohibitive and the investment horizon may be longer than many investors would like. They may “side pocket” or lock up a significant portion of their fund, to ensure they can stay in for the longer-term horizon. For more information on crypto hedge funds vs blockchain venture funds, and why we’ve chosen to focus on crypto hedge funds, please see our guide on investing in crypto, here.

On the other end of the spectrum, some funds may have a more liquid, short-term strategy, for example using quantitative methods, employing technical analysis and statistics to make investment decisions.

Which type of investment strategy should you invest in? That depends on your own outlook, including tolerance for risk, and your belief in which strategy will return. At BitBull’s Fund of Funds, our decision has been to invest in 10 funds with diverse strategies; diversification can reduce the risk associated with returns.

All funds share past performance records to some extent, and these, coupled with details on the strategies they use, should serve as good measures for you to shortlist those which align with your goals and risk appetite.

Conducting due diligence on shortlisted funds

Due diligence is the next step after shortlisting suitable crypto hedge funds. You can contact each shortlisted fund and start by asking for a presentation deck, which typically includes details on the fund’s setup, managers, strategies, past and present investments as well as performance record. Basic diligence involves verifying the information in the deck, whether through the fund third-party administrators, other investors, or by getting references from your network. Once you are satisfied with a fund’s presentation, prepare a set of questions to discuss over a call with founders or managers.

Questions to ask before selecting a crypto hedge fund – The questions for your in-person or online meeting can broadly be divided into the following categories.

Background information

This category deals with the fund manager’s backgrounds and history. Your goal here is to understand where the manager(s) is coming from, what they did before this, what qualifications they have and how is their track record.

For instance, if you’re looking into a crypto hedge fund which invests based on fundamentals, the manager should have a track record of picking long-term winners as well as access to networks for exclusive private deals. On the other hand, the manager of a quantitative fund should have the requisite qualifications and should understand algorithmic trading and models.

AUM and performance

Your next set of questions should be directed towards the fund’s assets under management (AUM) and performance.

The AUM figure, coupled with the number of limited partners (LPs) will reflect a fund’s size and type of investor exposure. While most investors may think that higher AUM is better, this is not true; there are benefits to both high and low numbers. For example, high-AUM funds may be approached earliest by private deals, while low-AUM funds may be more nimble in this sector with relatively low liquidity. In either case, the performance figures should also be compared to funds with similar AUM and LP numbers in order to get a better picture.

Performance during down periods for the asset class should also be looked at carefully, as should periods of maximum draw-down, so that you begin to understand the strategy’s risk profile. For example, do you prefer a fund that goes up 40% when crypto is up 30%, and down 40% when crypto is down 30%? Or, do you prefer a fund that goes up 4% when crypto is up 30%, and down 4% when crypto is down 30%? Or, do you prefer a market-neutral fund that returns between -1% and +3% monthly, regardless of crypto’s price change, and simply based on attempting to profit from its volatility?

Where does crypto falls in your particular portfolio? In answering these questions, you will also want an understanding of the % weighting in your portfolio you’re giving to this investment. If small, you may have a higher tolerance for risk.

Strategies

Even though you are going to be trusting the fund manager’s expertise, you should ask about the strategies they implement and how they are executed. For instance, a fund relying on arbitrage as a strategy may either be doing it manually or using an algorithmic model – in each case, the results may vary, and knowing how your shortlisted fund operates is key to making an informed choice.

For our Fund of Funds, we monitor closely the weightings of the different strategies we’re invested in. For example, in one period we may want to be exposed to earlier-stage coins and ICO funds, whereas in other periods we may prefer longer-term investments with funds that do equity investments in blockchain companies, and in other periods we may want to weight towards funds that use market-neutral strategies.

Operational diligence, including security measures

When it comes to crypto, security is a paramount concern, given how easily crypto assets can be hacked or lost. While there are institutional-grade custody solutions available today, most funds self-custody. In either case, you should ask about the safety measures they have implemented and whether they are qualified for self-custody.

Investment terms

Finally, before you sign on the dotted line, ask about the relevant investment terms, particularly a fund’s fee structure and schedules. These are in a document called the Private Placement Memorandum (PPM). It’s important to read this thoroughly For example:

Do investors have a perpetual high water mark? This means that the fund cannot take a performance fee unless they have made you more money than you originally invested.

What are the management and performance fees? We’ve seen management fees ranging from 0-3%, and performance fees ranging from 20-40%. Typically, a fund that has a low management fee, e.g. 0%, will have a higher performance fee, e.g. 30%. Standard in crypto is 2%/20%. This is slightly higher than the fee structure for non-crypto hedge funds, but crypto hedge funds also encounter costs including custodial fees that are not typical in equities.

Some funds also have hurdles; our fund of funds, for example, has a “soft hurdle” of 10%, which means that we do not take any performance fee at all until the annual return of an investor is over 10%. The soft hurdle means that, if the return is over 10%, the performance fee then applies to both that first 10% return as well as returns above the 10%.

When are these fees taken? We’ve seen funds that assess fees as often as monthly, which can cut into your compounding, or as infrequently as annually. Quarterly or annually is standard.

There are a host of other terms that you should be familiar with, including minimum investment size (this ranges from $25K to $3M), lock-up (this ranges from none to 3 years), and redemption terms (when and how can you get your money back?). As an example, please see the key terms of BitBull Fund here.

Conclusion

If everything is to your satisfaction, you can request a fund’s PPM and subscription documents for review. Don’t skip on the legalities and feel free to ask questions if something is unclear. Ultimately, your goal should be to make an informed decision, without having to worry about unexpected fees and terms & conditions. At BitBull, we have about 200 questions we ask hedge funds. Here are some initial diligence questions:

How many funds/products/strategies do you offer, and what are they?

Monthly/Quarterly/Yearly performance, as recent and as far back as available.

Any performance metrics on your fund(s), such as Sharpe ratios, max drawdown, etc.

Fee structure

Lock-up period and fund liquidity – daily, weekly, monthly, annual? Notice period for redemptions?

Minimum investment.

How frequent is reporting of an investor’s Net Asset Value (NAV)?

What is your edge?

Do you accept in-kind contributions? (i.e., can investments be made in Bitcoin or crypto in addition to dollars)

Can I invest via an IRA?

Funds should be up-front and happy to answer any questions you have. If you have difficulty getting answers or don’t feel that the fund is responsive during the process, don’t expect that to change when you’re an investor. While this guide is introductory in nature, it outlines the most important considerations before choosing a crypto hedge fund. If you’d like more assistance or have questions, feel free to reach out.