ISSUE 1

December 21st 2018

Hi again,

Over this past weekend Bitcoin fell to about $3,200, its lowest price in 14 months. Many asked us why, and whether we believe it’s at a buy point. We’ve used this as a catalyst for our first issue of BitBull Capital’s ‘Crypto Investing’.

Below are links to curated research and news, including our own whitepaper about Bitcoin at Major Buy Point, articles on Stablecoins, and the current strong Bitcoin sentiment.

We’ll continue to curate Crypto Investing news and knowledge for you. As always, if you’d like to discuss crypto investing or the reasons for large price movements this week, don’t hesitate to schedule a chat.

The SEC reiterates their stance on crypto

The SEC reiterates their stance on crypto

The SEC has become increasingly active in the crypto world in the past few months . In November they issued a rare tripartite release…

Stablecoin project Basis is shutting down

The algorithmic model proved impossible to implement within the context of the U.S. financial regulatory environment.

Crypto’s Terrible Year Was Actually Pretty Good

Crypto’s Terrible Year Was Actually Pretty Good

People tend to overlook what happens after a crash. 2018 saw verified individual users double from 17 million to 35 million.

Trend

Bitcoin At Major Buy Point

Bitcoin At Major Buy Point

Bitcoin is now at a major buy point, and the best price it’s been in 14 months. If you missed Cyber Monday, Bitcoin is still on sale

Research

Strategy

Bear markets are good because they clear the malinvestments of the bull market. Here are few tips on getting through a Bear Market.

Regulation

The G20 said that it intends to help crypto create an open and resilient financial system and emphasized that it is “crucial to support sustainable growth.” Read the full G20 declaration

Tweets of the Week

Global debt is now over $184trillion. That is 225% of global GDP and $86,000 per person.

Bitcoin isn’t the bubble, its the pin. Link

Tweets of the Week

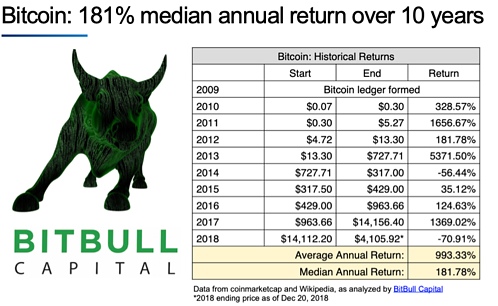

From our “Bitcoin at Major Buy Point” research: over 10 years, Bitcoin’s median annual return has been 181%. Its average annual return? 993%. Link

If you value Crypto Investing, feel free to forward this copy to your friends to help us grow.

Happy Holidays!

Joe DiPasquale – CEO at BitBull Capital