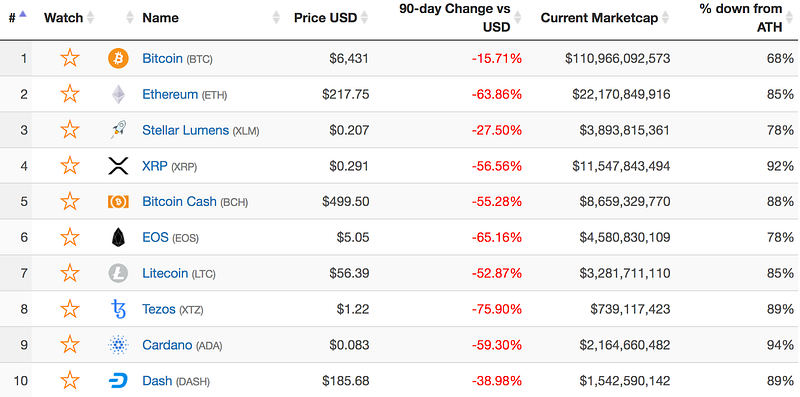

Bitcoin lost over 12% this month, dropping from a high of $7,380 to roughly $6,400 today, and took the market down with it, with every altcoin in the top 10 taking a beating, including Ether, XRP, Bitcoin Cash and Cardano.

While this recent drop came after news broke regarding Goldman Sachs’ decision to put their crypto trading desk plans on hold (which has now been disputed by their CFO), a look at the 90-day price trend for top 10 cryptocurrencies paints an even bleaker picture.

While Bitcoin is down only about 16%, altcoins have taken a major beating, with Ether recording a massive 63.86% decline, despite being the second most popular cryptocurrency.

Reasons behind this trend

One of the major reasons behind this trend is the market’s dependence on Bitcoin. Not only is it the leading currency, it is also the dominant pair against altcoins on all popular exchanges. Moreover, investors, traders and analysts believe in Bitcoin’s resilience, while other digital assets are commonly seen as ‘fancy clones’ or overly-hyped coins with little to no real-world utility.

This means when Bitcoin goes high, investors and traders ride the wave and then diversify their profits by investing into altcoins (that’s why altcoins reached their peaks earlier this year, when Bitcoin was near it’s all-time-high). Similarly, when Bitcoin price starts to decline, investors sell their altcoin holdings to either get Tether (USDT) as a hedge or go back to Bitcoin to preserve their crypto holdings (which are often calculated in the number of Bitcoins-worth of crypto). This results in altcoins almost always taking a major beating when Bitcoin slides, and explains why the chart above shows most top 10 altcoins being down by over 80% from their all-time-highs (while Bitcoin is down only 68% in comparison).

What can we expect in the next 90 days

The market’s direction will be dictated by Bitcoin’s price movements in the coming 90 days. Disregarding the recent drop, there is optimism surrounding upcoming institutional solutions (Bakkt platform, NASDAQ’s involvement), regulations (SEC’s willingness to fairly consider ETF proposals) and the VanEck ETF proposal, which many believe is the most likely to get approved.

If the VanEck ETF proposal is approved, it will open the gates for a huge chunk of retail investors to pour money into Bitcoin, which should result in a surge which will positively impact the entire market.

In such a scenario, we should see altcoins recovering, and possibly nearing their all-time-highs if Bitcoin manages to reach $20,000 again.

However, if the VanEck proposal is rejected, or a decision is postponed, we may see Bitcoin drop further and find a floor, where it is likely to stay until new developments pan out. In that case, altcoins are likely to suffer as a whole, except for cases where a particular coin manages to gain attention and create hype.

In either case, all eyes are on Bitcoin.

Subscribe here for updates on blockchain and crypto investing.