Our cheat sheet is available here, and BitBull Capital Research’s market commentary is below.

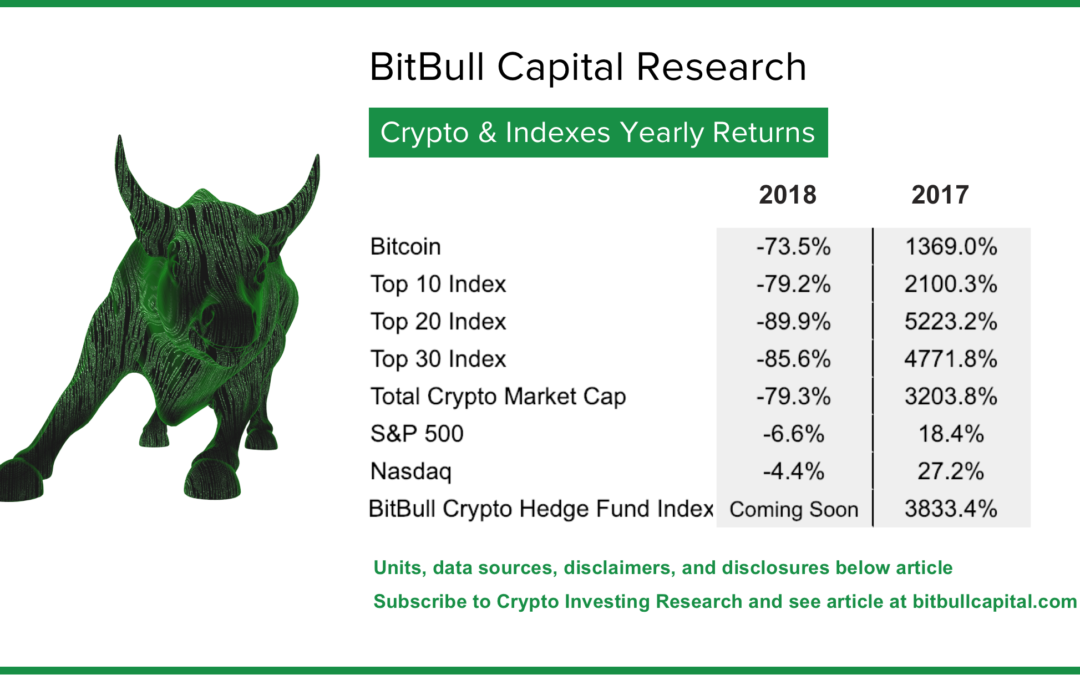

Today, Bitcoin completes another year; one of its most bearish returns since its inception 10 years ago. Yet even with its decline in value, Bitcoin has returned an average of 993% annually since inception. At BitBull Capital, we diligently follow and research crypto’s returns, informing our fund of funds’ diligence of crypto hedge funds. We compare crypto hedge fund returns against Bitcoin, crypto indexes, the dollar, and the S&P, and use a “cheat sheet” that compiles these returns. Today we are releasing this cheat sheet, so that others can benefit from a side-by-side comparison of Bitcoin vs Crypto Indexes and other crypto returns.

Stay tuned for additional crypto return information, including aggregated information on crypto hedge fund returns, the BitBull Crypto Hedge Fund Index. We’ve included the 2017 number for the BitBull Crypto Hedge Fund Index return, based off an average of the returns of several crypto hedge funds in that year. This will help provide data to answer: have crypto hedge funds performed better than Bitcoin and/or a crypto index? For those seeking consistent alpha, the returns in this index are sure to be interesting.

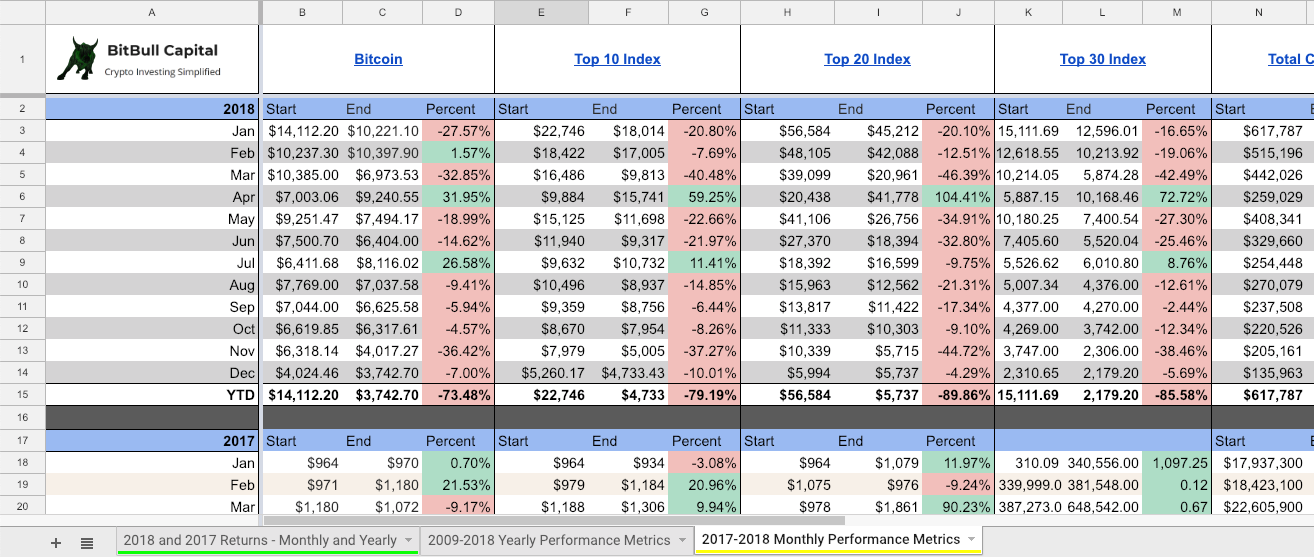

A snapshot of our spreadsheet available here.

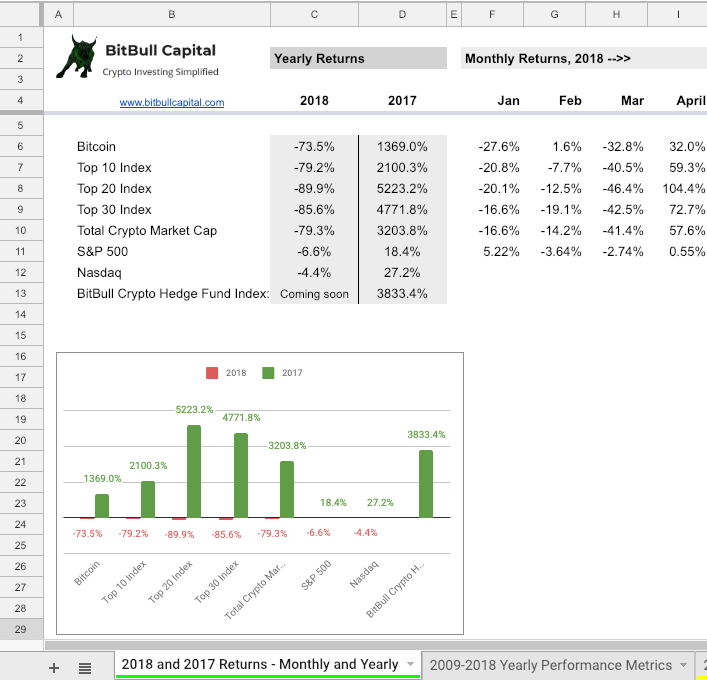

A snapshot of our spreadsheet available here.

2018, Year of the Bear

After the 3204% surge we witnessed in 2017’s total crypto market cap, the bear returned in 2018, keeping the entire crypto market down, with the total market cap dropping 80% in 2018. The first major drop came in January (-16.60%), followed by March (-41.40%), after which there was relative stability, with a short-lived surge in April (+57.60%). However, prices continued to drop as expected developments were stalled, including the rejections of many proposed ETFs and scaling issues faced by Ethereum, the most popular cryptocurrency after Bitcoin. November then marked the biggest drop (-35.90%) since March, amidst the Bitcoin Cash fork controversy, while December was largely volatile leading up to the new year. Bitcoin hit a closing low of $3,236.76 on December 15, 2018, and ended the year at 3,742.70 , up 15.7% from its low.

Interestingly, when compared with the top 10 (-79.20%) and top 30 (-85.60%) cryptocurrency indexes, Bitcoin has shown the most resilience, declining by 73.50%. These numbers reaffirm Bitcoin’s position as the leading crypto with relatively modest volatility. The top 30 crypto index also shows much more volatility than the top 10 crypto index.

Understanding Bitcoin’s Influence on the Market

The dynamics behind Bitcoin’s influence on the market are multi-layered. Firstly, it is evident that all other cryptocurrencies, generally, follow Bitcoin’s price action – which means when Bitcoin appreciates, other currencies ‘typically’ appreciate shortly afterward. But, when Bitcoin drops, other cryptocurrencies ‘definitely’ follow suit; however, in both instances, the effects are amplified for altcoins.

The case in point can be seen from numbers March to August, where Bitcoin dropped by 32.80% in March, but the top 20 index recorded a 43.90% decline. Similarly, when Bitcoin surged by 32% in April, the top 20 index appreciated by 93.50%.

However, in July, Bitcoin’s increase of 26.60% was only followed by a 6.0% increase in the top 20 index. And when Bitcoin dropped by 5.9% in August, the top 20 index dropped 21.60% – which goes to show how the effects of a drop in Bitcoin price are more strongly felt in the market than a surge.

The reason behind this influence is the fact that most cryptocurrency exchanges use Bitcoin as a primary market pair, against which all other cryptocurrencies are traded. This gives Bitcoin a unique dominance, as crypto holdings are measured in Bitcoin rather than the various altcoins.

This effect is further propagated with Bitcoin being the cryptocurrency of choice when it comes to large institutional moves and developments, such as the launch of futures contracts, be it by CME, CBOE or Bakkt, all of whom pick Bitcoin as the first currency for new products.

Is Bitcoin a Better Cryptocurrency to Hold?

Bitcoin has been the least volatile and the first to recover when a bull cycle begins. However, once the market is in a recovery cycle, diversifying into promising altcoins, such as the ones in the top 20 or top 30 indexes, can be very profitable, since they tend to appreciate a lot more.

Earlier this month, we published our report on Bitcoin being at a very strong buy point, and our reasoning is the same. At this price point, we believe Bitcoin is a very solid contender. As it recovers, the market should follow suit and appreciate considerably. Historically, this has meant even higher price appreciation for top alternative coins, but historical returns do not predict future returns.

A snapshot of our spreadsheet available here.

Want more? For more similar insights and reports, be sure to subscribe to our Crypto Investing mailing list, available at www.bitbullcapital.com

Units and data sources:

- Bitcoin: USD, CoinMarketCap https://coinmarketcap.com/currencies/bitcoin/historical-data/

- Top 10 Index: USD, Bitwise 10: https://s3.amazonaws.com/static.bitwiseinvestments.com/IndexPerformance/indexReturns-BITX.csv

- Top 20 Index: USD, Bitwise 20: https://s3.amazonaws.com/static.bitwiseinvestments.com/IndexPerformance/indexReturns-BITW20.csv

- Top 30 Index: USD, CCi30: https://cci30.com/

- Total Crypto Market Cap, USD (billions). CoinMarket Cap: https://coinmarketcap.com/charts/

- S&P 500: https://dqydj.com/2018-sp-500-return/

- Nasdaq: USD, NASDAQ Composite: https://dqydj.com/2018-nasdaq-return/

- Bitcoin, and Ethereum, and Crypto Market Cap numbers for Dec 31, 2018 are exact, taken on Jan 1, 2018.

- Index numbers for Dec 31, 2018, are precisely approximated based on returns of crypto assets as of Jan 1, 2018

- BitBull Crypto Hedge Fund Index 2017 is based on BitBull Capital’s research on crypto hedge fund returns and is the average return of several crypto hedge funds in 2017

Disclaimers:

- Performance of an index is not illustrative of any particular investment.

- It is not possible to invest directly in an index.

- Performance prior to the inception date of each index represents a hypothetical, back-tested, and unaudited return-stream that does not represent the returns of an actual account.

- Index performance does not include the fees and expenses that may be charged by funds.

- Actual returns may differ materially from hypothetical, back-tested returns.

- Back-testing is calculated by retroactively applying a financial model or Index-weighting methodology to the historical data to obtain returns.

Disclosure:

As of the publication date of this report, BitBull Capital Management LLC and its affiliates (collectively “BitBull”), others that contributed research to this report and others that we have shared our research with (collectively, the “Investors”) may have long or short positions in and may own options on the token of the project covered herein and stand to realize gains in the event that the price of the token increases or decreases. Following publication of the report, the Investors may transact in the tokens of the project covered herein. All content in this report represent the opinions of BitBull. BitBull has obtained all information herein from sources they believe to be accurate and reliable. However, such information is presented “as is,” without warranty of any kind – whether express or implied.

This document is for informational purposes only and is not intended as an official confirmation of any transaction. All market prices, data and other information are not warranted as to completeness or accuracy, are based upon selected public market data, and reflect prevailing conditions and BitBull’s views as of this date, all of which are accordingly subject to change without notice. BitBull has no obligation to continue offering reports regarding the project. Reports are prepared as of the date(s) indicated and may become unreliable because of subsequent market or economic circumstances.

Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the potential complete loss of principal. This report’s estimated fundamental value only represents a best efforts estimate of the potential fundamental valuation of a specific token, and is not expressed as, or implied as, assessments of the quality of a token, a summary of past performance, or an actionable investment strategy for an investor.

This document does not in any way constitute an offer or solicitation of an offer to buy or sell any investment or token discussed herein.

The information contained in this document may include, or incorporate by reference, forward-looking statements, which would include any statements that are not statements of historical fact. These forward-looking statements may turn out to be wrong and can be affected by inaccurate assumptions or by known or unknown risks, uncertainties and other factors, most of which are beyond BitBull’s control. Investors should conduct independent due diligence, with assistance from professional financial, legal and tax experts, on all tokens discussed in this document and develop a stand-alone judgment of the relevant markets prior to making any investment decision.