The most underreported event in crypto is the effect of futures contracts on the underlying market. Time and again we have seen Bitcoin price react to contract opening and closing dates. The latest Chicago Mercantile Exchange (CME) futures contract expired on August 31, after which we’ve seen a steady rise.

As reports of market manipulation in crypto become more rampant, Bitcoin futures must be acknowledged as another way in which professional investors, hedge funds, and other whales can legally exert pricing pressure on Bitcoin.

Several veteran traders and analysts have been quoted saying that the actual purpose of a futures market is to manipulate the underlying asset and kill volatility, which is also something we are seeing in Bitcoin’s price, now moving in an uncharacteristically narrow range from $6,000 to $8,000 USD for the last three months.

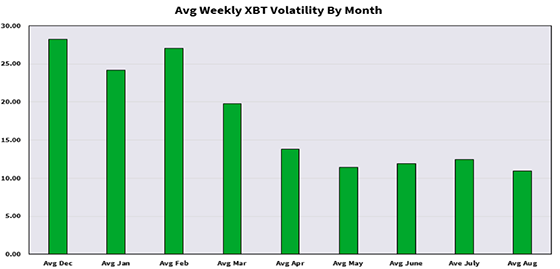

For example, August recorded the lowest volatility since last December on CBOE’s Bitcoin (XBT) futures contracts.

According to Peter Brandt, institutional investors use liquidity to accumulate and increase their holdings while retail traders are slaughtered on the swings. This decreasing volatility may kill retail traders.

This argument is also supported by the fact that volumes on futures exchanges have been increasing steadily (while volatility has been decreasing), indicating that we are likely to be in an accumulation period, which may soon spell the end of this bear market. Moreover, given the positivity surrounding the VanEck ETF proposal, which will open the doors wide for institutional investors, it makes perfect sense to accumulate now.

This trend is likely to continue until the bears are exhausted, and we see a short squeeze which then starts a new bull run. However, at the time, BTC-USD shorts on Bitfinex are experiencing a correction, so there isn’t a lot of fuel for a big squeeze, which may result in the continuation of a bearish trend.

Want more perspective on the latest happenings in crypto? Sign up for email updates.