Satoshi Was a Man Who Wanted to Change the World

One of the main reasons Bitcoin adopters are so pro-Bitcoin is because of its beginnings.

Once upon a time, almost nine years ago, there was an anonymous developer named Satoshi Nakamoto…

Hold on! I am not going to retell the Satoshi story again — it’s been done to death — but the key takeaway here is that Satoshi remained anonymous.

Dark Web Before the Dark Web

Bitcoin was born in the darkest corners of the internet, where cypherpunks, hackers, and Austrian school economists dwell.

It was designed to be a peer to peer medium of exchange that was censorship resistant, and did not rely on trusting a 3rd party in order to transact.

Satoshi included a headline of the financial crisis of his time in the genesis block of the bitcoin blockchain, and it will forever stand as a testament to his real motivation.

The headline was, “The Times 03 Jan 2009”

“Chancellor on Brink of Second Bailout for Banks”

Bear with me now, this isn’t going to become a long-winded political statement. I simply said that to say this:

Satoshi invented Bitcoin to be a stand-alone economic system, that was not correlated to the world economy at large.

Bitcoin: Digital Asset? Cryptocurrency? Digital Gold?

This creates an unusual set of circumstances for all of us after the fact, now that Bitcoin is on the cusp of mass adoption and mainstream appeal.

First, how does one classify Bitcoin? This is the million-dollar question still trying to be determined by economists, fintechers, and lawmakers. Is it an asset, currency, store of value?

Second, after you have classified Bitcoin, how do you value it?

To keep this article to the point, I will let smarter men than me decide the answers to those questions.

I will add that Warren Buffet, the legendary oracle of Omaha, has said that Bitcoin cannot be valued because it’s not a cash producing asset, and traditionally, currency falls under this definition.

A Tale of Apples and Oranges

In an effort to assign value to Bitcoin, many have tried to compare it to gold or another commodity; others have tried to compare it to the stock market; and still others, to forex.

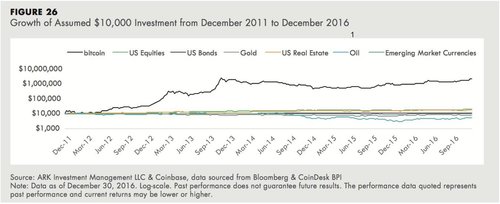

The results are hardly surprising: Bitcoin doesn’t correlate well with any other asset class. Bitcoin stands alone as its own microeconomy.

I know you are probably wondering how we can make this information work for the savvy investor. I would like to propose that Bitcoin is a new asset class, and as such, it is not correlated to any of the other financial markets.

It can be an excellent hedge in any diversified portfolio. It acts as an exciting new asset that can hedge against risk in more traditional investments, while at the same time having an amazing potential for profit, that has outperformed everything else.

Encryption Backed Renaissance

The best part is that this isn’t even the most exciting thing about this new technology. I’m sure you’ve heard the endless buzz about blockchain.

Bitcoin is just one of thousands of new blockchain based digital assets that are going to change every facet of our society in ways we can’t even imagine. Decentralization is set to radically disrupt a multitude of industries.

We are heading towards a nexus of blockchain, artificial intelligence, and the internet of things, which are set to bring us fully into the future.

In short, my friends, Bitcoin is only the beginning.