Institutional investors are entering the crypto space for many reasons, including research that shows a low correlation with other assets. Apart from the numerous crypto hedge funds, notable university endowments, including Yale are already invested in cryptocurrencies. Similarly, recent surveys indicate that more than 50% of institutional investors are keen to add cryptocurrencies to their portfolios.

This positive interest comes at the heels of major developments, both in terms of transparency of crypto markets and the safe custody of crypto assets. The markets continue to mature with various instruments offered by reputable names including CBOE, Fidelity, ICE, and CME, as well as the efforts of existing stakeholders, such as Coinbase.

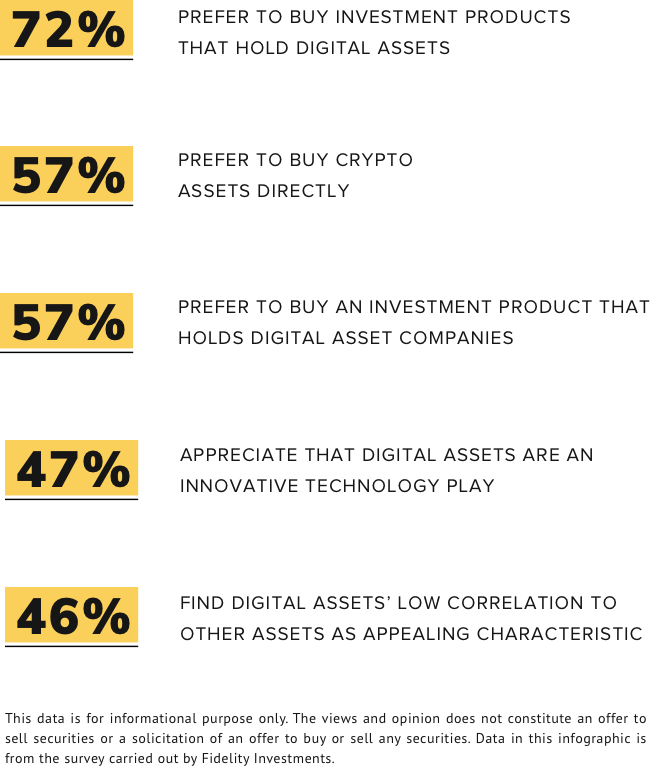

Institutional investors want a piece of the crypto pie, as per a survey commissioned by Fidelity Investments. Key findings of the survey are:

At BitBull Capital, our funds, including a crypto fund of funds and an Opportunistic Fund, service forward-looking family offices around the world, facilitating the much-needed diversification of their portfolios and helping them find a balance between traditional financial instruments and digital currencies.

Become An Investor Today

Our Fund of Funds aims to invest in the leading equity and token investment funds. Similar to Venture Capital, we believe access to the most competitive deals can create significant alpha. Yet, you can invest in our funds without any lock-up; crypto can be a means of “liquid venture capital.”

Joe DiPasquale, CEO of Bitbull Capital, shares thoughts with Jill Malandrino on the recent market volatility — and how hedge funds profit from it — on NASDAQ trade talks.

Joe DiPasquale discusses factors that influenced the price drop in Bitcoin and crypto in general on Bloomberg.

Our active involvement and relationships in the space open us up to amazing early-stage opportunities which our members get to benefit from. Through the crypto winter – in November and December of 2018, Bitcoin was down 35%, while BitBull’s Opportunistic Fund (“BitBull”) returned +29%. Learn more about how we outperform the bear market which negatively impacted the entire crypto space?

During the Crypto Winter

SERVICE PROVIDERS

Trident

Administrator

Richey May

Auditor

Harney’s

Offshore Counsel

DMS

Regulatory Counsel

Cole Frieman Mallon

US Counsel

FREQUENTLY ASKED QUESTIONS

Does BitBull accept non-US investors?

What is an Accredited Investor?

Can I invest through an IRA?

How can I see the performance of my investment?

How do I make an additional investment, after I’ve already made an initial one?

Do you accept in-kind (e.g. investments in bitcoin instead of dollars)?

Disclaimer

Performance information is provided for informational purposes only. Past performance of the management team is not necessarily indicative of future results, and there can be no assurance that any projections, targets or estimates of future performance will be realized. Actual performance of the Fund may vary substantially from the performance provided on this Website. An investor may lose all or a substantial part of its investment in the Fund. Careful consideration should be given to any performance data provided herein. Fund returns are calculated net of expenses. Investments are subject to fees that includes the management fee, custody charges for holding the fund’s assets charged by the custodian, and customary fees and expenses of the fund administrator and auditor.

The performance of the Fund will be reduced by any and all applicable fees or expenses charged to and by the Fund, which could be more than the fees and expenses incurred with respect to investments held by the Manager. Performance returns of the Fund may be materially less than that of the Manager.

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS