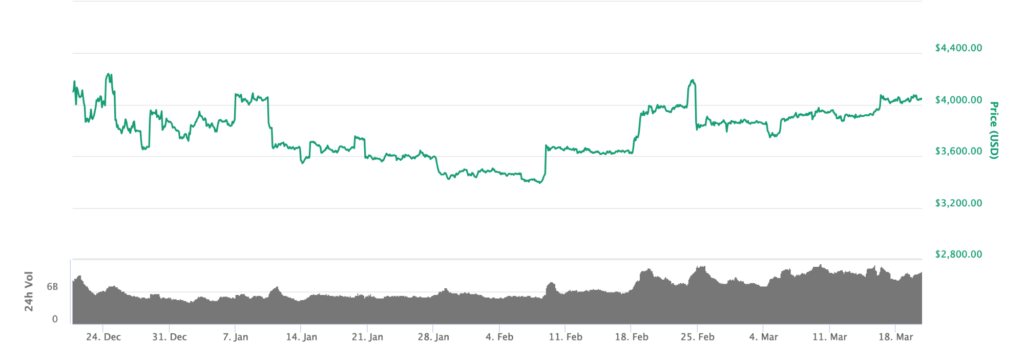

After a rather lackluster 2018, Bitcoin, and the crypto market as a whole is having a positive year so far, with Bitcoin crossing the $4,000 mark twice in the last two months. In this article, we will discuss the possible reasons behind this rise and why we expect BTC to hit $5,000 soon.

Price Consolidation and Increasing Volumes

Over the last three months, we have seen Bitcoin trading sideways with short bursts triggered by various events, but the key indicator here is the increasing trading volume, which, as of today, stands at $9.3 billion, and has already crossed $10 billion five times this month.

The last time we saw Bitcoin trading volumes this high was in late April – early May 2018, when BTC prices were in the $9,200 – $9,800 range.

At the current price, these volumes are confidence boosters, signaling increasing activity, price consolidation, and possible accumulation, resulting in steady price appreciation.

Increasing Interest Around Crypto and Blockchain Technology

The rising Bitcoin volume mentioned above is a sign of increasing engagement, which can be attributed to the developing interest around crypto and blockchain technology this year.

We first had JPMorgan announcing their own digital asset, the JPM Coin, followed by unconfirmed rumors around Facebook launching its own digital currency. Even Twitter’s founder and CEO Jack Dorsey stated that he is buying $10,000 worth of Bitcoin every week.

Last month Samsung, the tech giant, also unveiled its flagship Android phone, the Samsung Galaxy S10, which came with a built-in crypto wallet, further spurring interest in the cryptocurrencies.

Another major boost for Bitcoin and Litecoin came with the Venezuelan government’s official approval of a crypto remittance service for locals to receive crypto payments (in Bitcoin and Litecoin), which are paid out in the country’s native currency.

Finally, we had good news from Fidelity this month, which launched its crypto custody solution for selected clients, “focused on the needs of hedge funds, family offices, pensions, endowments, other institutional investors.”

Futures Market Triggers

Bitcoin’s decline from $20,000 was largely attributed to the launch of futures contracts, which essentially allowed traders to profit from shorting the digital asset. Since then, there are correlations drawn between Bitcoin price and the start and expiration of new futures contracts by main exchanges like CBOE, CME, and BitMEX.

Earlier this month, CBOE stated that they will be suspending the creation of new futures contracts indefinitely, while BitMEX had new futures contracts starting from March 15, 2019. Given how BitMEX futures show a volume of $1 billion at the time of writing, leading Bitcoin trading, the price surge can also be attributed to the start of new, September futures.

Increasing Adoption and Improving Fees

Bitcoin has been undergoing technological improvements, with Lightning Network and SegWit addresses reducing transaction fees and network congestion and improving settlement times (by March 16, average Bitcoin transaction fees were reduced from around $0.15 to $0.05).

These developments have also encouraged Bitcoin adoption, recent examples of which are announcements from two of the largest online retailers – Digitec Galaxus and Avnet, which will be accepting Bitcoin payments moving forward.

The increasing adoption and usability improvements are also key factors behind Bitcoin’s price appreciation and benefit the entire crypto market.

Bitcoin at $5,000 is not unrealistic

At BitBull Capital, we have long maintained our target price of $5,000 per BTC for this year, and given the recent price trends and market developments discussed above, we may see this price point sooner rather than later.

Currently, the $4,000 level is crucial and Bitcoin needs to break through $4,300 before an easier climb towards $5,000.

To summarize:

- Bitcoin price has been consolidating around the $3,800 range with steadily increasing volumes supporting the break over $4,000

- Record high Bitcoin trading volumes reached since May of 2018

- Bitcoin price surge is supported by increasing interest in blockchain and crypto, from various quarters

- JPM Coin

- Facebook Coin rumors

- Venezuelan government’s approval for crypto remittances

- Twitter CEO’s support for Bitcoin

- Samsung’s flagship phone coming with a built-in crypto wallet

- Bitcoin futures market events can be correlated with price movements

- CBOE suspended futures

- BitMex launched new contracts for September

- Improvements in the Bitcoin network coupled with increasing adoption

- Bitcoin fees have reduced significantly with SegWit and Lightning Network

- Online retail giants Digitec Galaxus and Avnet will be accepting Bitcoin payments