Bitcoin is perhaps one of the most, if not the most, polarizing assets in recent years, making its way from the dark corners of the web to Wall Street, and giving returns that make even the most profitable traditional stocks and assets look slow in comparison.

The last three months, however, have been unprecedented in terms of Bitcoin’s performance, as it not only broke through the previous all-time-high around $20,000, it went on to touch $40,000 within weeks before profit-taking brought it down to current levels around $34,000.

With new media coverage and a lot of hype around its price gains, new investors naturally ask, is it too late to buy Bitcoin now? And while this is mostly a subjective question, we at BitBull Capital, hold the view that it is not too late, and here is why.

Schedule a call with us to discuss Bitcoin investment options via our funds

Bitcoin’s historic price trajectory is positive

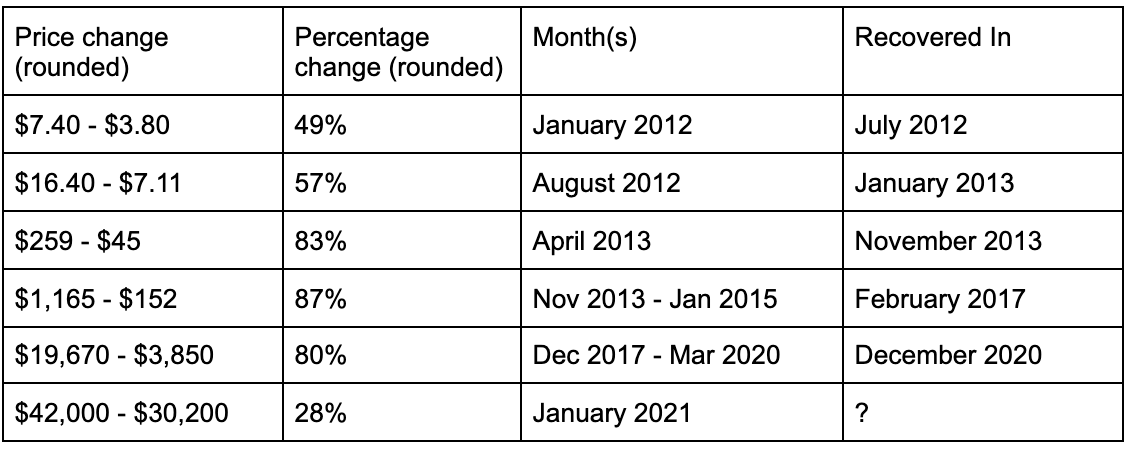

Bitcoin’s price drops are generally followed by skepticism and media coverage calling them crashes the digital asset may not recover from. However, looking back at Bitcoin’s historic performance, we can see that price drops, even bigger than the ones seen recently, are part of its rise over the years. For instance, Bitcoin fell from around $7.40 to $3.80 in January of 2012, marking a decline of over 48%, only to recover that level and surpass it in July of that year.

The chart below highlights Bitcoin’s historic highs and the subsequent lows it touched prior to reclaiming those highs.

Looking at these figures, especially the percentage terms, it is clear that Bitcoin has undergone and recovered from massive price drops, and even though the drops at current levels may appear daunting in USD terms, they aren’t so much in the more objective, percentage terms.

What this ultimately means, and something we will discuss later in this article is that Bitcoin’s price, throughout its history, has never been “too high to buy”.

Bitcoin’s future prospects are promising

Bitcoin is unlike any other asset in the world’s economic history. Even though it is likened to gold, its utility, characteristics, performance, and market movements are not anything like the precious metal. We believe Bitcoin represents a very unique asset class, one that is extremely relevant today and is likely to be more so in the future.

When we give Bitcoin its own stage, we realize its potential place in an economy moving quickly towards a digital future. Add to this the growing mistrust of traditional banking institutions and fiat currencies, and you have a potentially disruptive new store of wealth and an alternative investment that is still in the very early stages of its life cycle.

Finally, all of these characteristics, when put together, make Bitcoin the asset of choice for millennials, and understandably so. All this means is that Bitcoin, as an asset, is in its infancy and is likely to grow, both in terms of adoption and value, in the coming years.

Bitcoin’s demand is growing but supply is shrinking

Bitcoin is designed to have a limited supply of 21 million units and no more. Unlike fiat currencies, which can be printed arbitrarily to stimulate economies, new Bitcoin’s cannot be created at will. The mechanism behind the emission of new coins is also subject to halvings that occur roughly every four years, further contracting the supply while demand has historically continued to grow.

Institutional demand aside, which we will refer to later, Bitcoin was adopted by PayPal in 2020, opening the gate for retail demand which is only going to put more pressure on the supply in the coming years.

New investors aren’t concerned about the price

2020 also saw massive institutional investment into Bitcoin, be it MicroStrategy buying hundreds of millions worth or other companies, like Square, adding sizeable amounts to their portfolios. It has been clear that new investors have not been very concerned with price, and have bought Bitcoin at every opportunity throughout this bull run.

Institutional demand is “unprecedented”

Grayscale, the New York-based crypto firm reported Q4 2020 as its biggest quarter in terms of investor demand, accounting for over $3 billion in inflows, dwarfing the firm’s lifetime flow of around $7 billion in comparison.

According to the firm, which started 2020 with $2 billion in AUM and ended it with $20 billion, it “experienced unprecedented investor demand” and outpaced the new supply of Bitcoins in Q4 2020.

The report also specifies that 93% of the $3 billion in inflows came from institutional clients while the firm received “substantial inbound interest from wealth managers”.

The stats here make it clear that institutions have been accumulating Bitcoin at recent prices, which is typically a positive sign for any asset’s future performance.

Other institutional funds are also bullish on Bitcoin and have witnessed an increasing demand in 2020, including Pantera, which raised $5 million recently, and the CEO of ARK Investment Management, Catherine Wood, who believes Bitcoin can hit $500,000 in the future.

If you’re still unsure about investing in Bitcoin, book a call with us today to discuss crypto investment opportunities suitable for your portfolio.