[contact-form-7 id=”49042″ title=”Hnews”]

Subscribe to Crypto Investing Newsletter

High-net worth individuals

Nearly 30% of high net worth individuals are very interested in crypto and we continue to help them get exposure to space.

Family offices

Family offices, both SFOs and MFOs, with significant assets seek diversification and turn to us for help adding cryptocurrency investments to their portfolios.

Angel Groups/Angel Investors

Angel investors are continually looking for early opportunities in rapidly growing sectors and we help them identify and invest in early-stage crypto ventures with disruptive potential.

Venture Capital / Venture Capitalists (VCs)

Family offices, both SFOs and MFOs, with significant assets seek diversification and turn to us for help adding cryptocurrency investments to their portfolios.

Private Wealth Managers/Private Banks

Nearly 30% of high net worth individuals are very interested in crypto and we continue to help them get exposure to space.

Non-US Investors

Family offices, both SFOs and MFOs, with significant assets seek diversification and turn to us for help adding cryptocurrency investments to their portfolios.

Institutional investors

Following the lead of some of the biggest university endowments and pension funds, an increasing number of small and medium bodies are interested in exposure to crypto.

RIAs and Money Managers

Due to mounting client demand, investment advisors and money managers are turning to specialized crypto funds and managers like BitBull Capital to help diversify client portfolios.

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Diversified Active Strategies

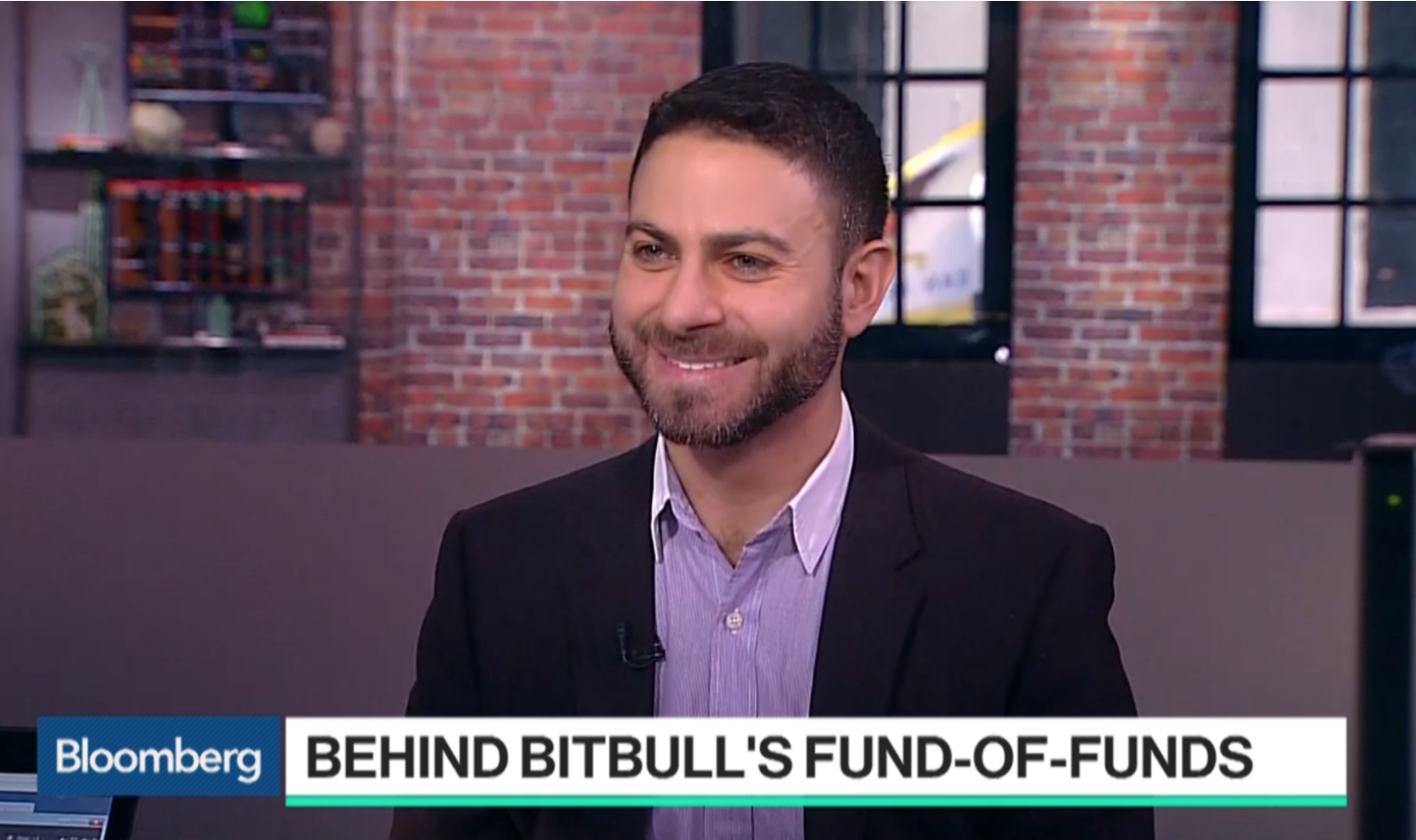

Manager: A 6 year track record of crypto investing

Joe DiPasquale, CEO of BitBull Capital has 6 years of crypto investing. Previously he worked in investment management, investment banking, technology, and strategy consulting at Bain and McKinsey. Joe completed his BA at Harvard University and MBA at Stanford University.

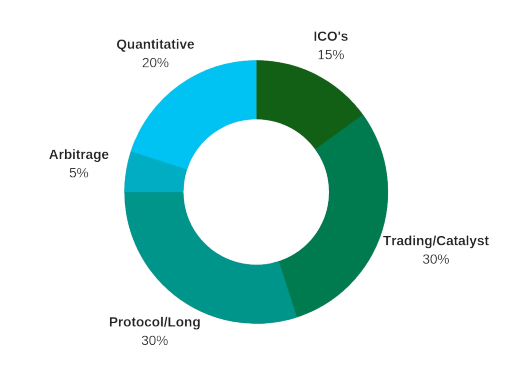

Our Strategy

BitBull Capital is the first cryptocurrency hedge fund of funds. We diversify your investment across multiple managers who specialize in a variety of strategies. BitBull manages a basket of 10 funds strategically selected from the 450+ crypto funds we have diligenced. We have access to introduction-only, closed, and multi-$M minimum funds. BarclayHedge named BitBull a top performing multi-advisor fund in April 2018 and again in July 2018.

A few of our funds: We select funds that we believe have the strongest approach to their specific strategy

What is your value proposition?

- First crypto fund of funds – historical returns

- Came out of Stanford’s StartX

- Known silicon valley entrepreneur who’s in closed funds such as Metastable Capital

- Research on 340+ funds

- Diversified portfolio

- Better terms

Why does Active management outperform an index

- We put together the best active management strategies in crypto, which are shown to outperform an index, with 0% management fees.

- Crypto hedge funds performed exactly 100X better than non-crypto HFs this year (693% vs 6.93%). And 150% better in 2017 vs just buying bitcoin. Their #s are a bit dated – now that Bitcoin is up 1500% this year, we’re seeing hedge funds that are up even 2500%. [EurekaHedge]

Does BitBull accept non-US investors?

Yes. Our offshore vehicle is currently accepting non-US investors

What is the lockup / liquidity of the fund?

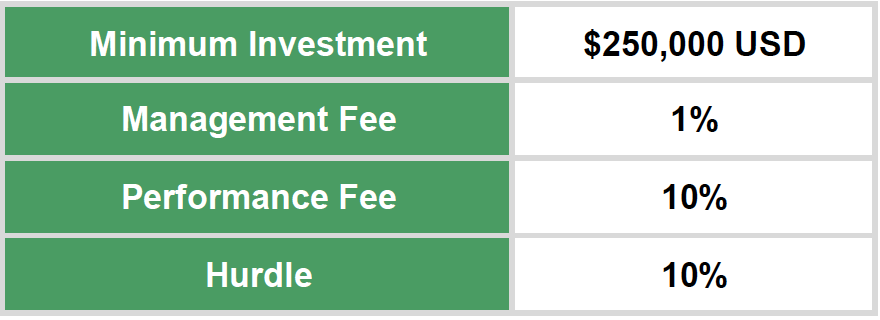

Investors may choose an annual lockup or a quarterly withdrawal option (with 95 days notice)

What is an Accredited Investor?

“Accredited Investor” is a status that individuals and entities qualify for if they meet criteria defined by the SEC (SEC bulletin here). It’s not something you apply for. There are several criteria. The most common criteria for individuals are if you made over $200,000 in the last two calendar years (or $300,000 with your spouse), or if you have greater than $1,000,000 in net worth, excluding your primary residence. For entities, common criteria are having total assets in excess of $5 million or if all of the equity owners are accredited investors.

Can I invest through an IRA?

We are currently accepting investments from self-directed IRAs at Pensco Trust and Entrust. Contact us for information on investing through an IRA.

How can I see the performance of my investment?

Investors in the fund receive a monthly email statement from our fund administrator that includes details of their capital account and investment returns. BitBull also conducts monthly investor web calls.

How do I make an additional investment, after I’ve already made an initial one?

You need to fill and sign an Additional Subscription Agreement. The minimum for additional allocations is $10,000.

How do I make an additional investment, after I’ve already made an initial one?

You need to fill and sign an Additional Subscription Agreement. The minimum for additional allocations is $10,000.

Please Select a Role

Financial Professional

Individual Investor