The price of Ethereum has escalated as DeFi has grown, and the future looks glistening for both.

In the Crypto world, “Ethereum” is ranked as the second largest cryptocurrency by market capitalization after bitcoin. Technically, Ethereum is the blockchain network in which decentralized applications are embedded, while ether is the token or currency that enables the use of these applications. In April 2021, the Ethereum market cap reached new heights and grew to over 250 billion U.S dollars. A large chunk of this market cap is driven by the central role that Ethereum plays in Decentralized Finance (DeFi). DeFi refers to financial services mainly built on the Ethereum network, that allows anyone to access financial products and services online in a decentralized manner. These services run on decentralized apps, known as dapps.

DeFi is relatively a new ecosystem in 2020, which has led to a tremendous increase in decentralized versions of traditional financial services that support autonomy, removing need for central authorities and creating a peer-to-peer financial network.

In fact, most of the DeFi applications are built on Ethereum blockchain and require the use of Ether for access to the protocol. DeFi attracted more people than ever in a very short time span and this has led to problems such as high transaction time, high electricity power consumption and expensive fees. So developers decided to use a protocol that will resolve stated common problems of Ethereum. And that is why Ethereum 2.0 came into picture.

This article will cover the various prospects of Ethereum 2.0 and how it is going to impact DeFi in future.

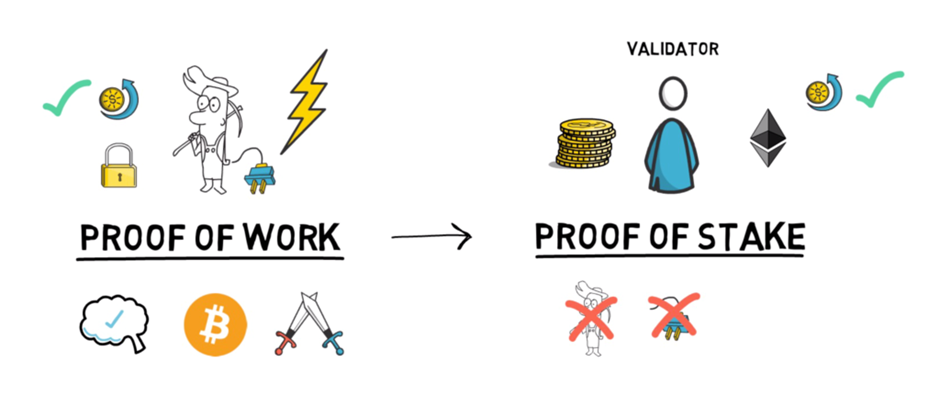

Transition from Proof of Work(POW) to Proof of Stake (POS) Consensus Mechanism

The most adopted consensus mechanism behind blockchain is Proof of Work (PoW) as outlined by Santoshi Nakamoto. In PoW, “miners” are required to verify transactions and to mine the next block. Consequently, mining process in PoW requires massive amount of energy to validate and secure the network. However, as competition builds the computing power requirements accelerates, resulting in high power consumption. That’s why to resolve the energy consumption issues an alternative consensus mechanism emerged, one of which is PoS.

In PoS, “miners” are replaced by “Validators”, who verify transactions and create new blocks. The users who want to secure the network, stake their ETH and become validators. Each validator is incentivised to validate transactions by receiving both the block reward and transaction fees.

In comments to OKEx Insights, Jehan Chu, the founder of the Ethereum Hong Kong community and the co-founder of Kenetic Capital, cited energy savings as one of the advantages of the upcoming upgrade for Ethereum:

“With the upgrade to Proof of Stake, Ethereum holders will be able to more directly participate in and benefit from maintaining the network by staking (a minimum of 32 eth) rather than running complicated hardware and burning electricity.”

Why Ethereum 2.0 is a huge leap forward for blockchain

Ethereum 2.0 has been one of the hottest topic for discussion for past few years. The Crypto Community is focussing its attention to the next major milestone- Ethereum’s Serenity upgrade, also known as Ethereum 2.0. This crypto launched in the second half of 2020 to solve the common issues existed there for so long. Ethereum 2.0 promises to enhance the performance by switching to Proof-of-Stake, which relies on validators and deposits of ether instead of physical miners and electricity.

The other major scaling technology of Ethereum 2.0 is “Sharding”. This is a mechanism through which the Ethereum blockchain is “split,” with data processing between many nodes and processed in parallel rather than one-by-one on a single node. Ethereum 2.0 will eventually facilitate up to approximately 100,000 transactions per second, compared to 4.7 TPS (Bitcoin), and 15 TPS (Ethereum).

Ethereum 2.0 Phases

There will be three major Ethereum 2.0 upgrades. Each of them has different timelines to release.

Phase 1-The Beacon Chain: Often cited as the Ethereum 2.0 release date, December 1, 2020, is actually the date of the beacon chain launching. Acting as a separate new chain, it will introduce the staking opportunities and prepare the ground for the next upgrades.

Phase 2-Shard Chains: Scheduled to be released in 2021, shard chains will solve the scalability-related issues by spreading the network load into 64 new blockchains. Shard chains are expected to enhance the transaction speed up to 100,000 transactions per second.

Phase 3-The Docking: The purpose of this phase is to “dock” the main-net Ethereum with the beacon chain. This would enable staking for the entire network and put an end to energy-intensive mining.

https://medium.com/okex-blog/ethereum-2-0-impact-on-users-dapps-defi-and-markets-8d848e55d495

ETH 2.0 Tech Changes would prove to be a “boon” for DEFI

Ethereum is on its way to change the decentralised financial market with its ETH 2.0 upgrade —also called Ethereum Serenity, which will bring better network security, scalability, and a better overall user experience. The upgrade version of Ethereum, which is expected to go live by 2022, still has a long way to be fully implemented into the heart of DeFi.

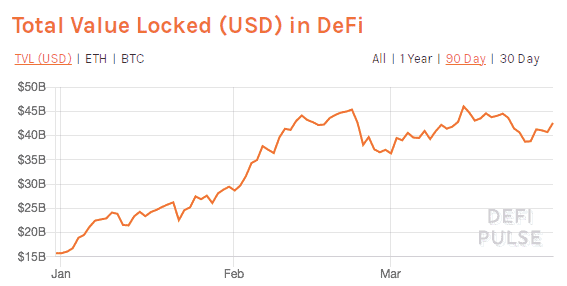

According to crypto market experts, Defi is the new era of finance and this took the crypto sector by a storm in the late summer of 2020.Hence, it can be said that 2020 proved to be a breakout year for Defi. Today, according to data taken from Defi Pulse: the total value locked up in DeFi has more than doubled from January this year to stand at over $42 billion.

The launch of Ethereum 2.0 was a crucial element driving the growth of total value locked in the Defi projects. Coin telegraph discussed this aspect further with Steven Becker, president and chief operating officer of DeFi project Maker DAO. He said:

“Eth2 is designed to optimize the network architecture without causing decentralization, security and scalability to suffer. Upgrades should enable Ethereum to scale to thousands of times its current capacity while remaining both secure and decentralized… which will be a boon for DeFi.”

Conclusion

Ethereum’s transition from PoW to PoS is intended to offer various benefits: more security, more democratic governance, and significantly more efficient usage of resources. Consequently, this will result in increased throughput, shorter transaction times, and lower transaction fees.

Ethereum 2.0 with its PoS consensus mechanism is expected to introduce a new DeFi round by solving the common issues existing due to current protocol and making it far more scalable and accessible. Regardless of Ethereum 2.0 progress, 2021 is likely to bring DeFi to the next level as it percolates into legacy finance.