BitBull Capital Funds

Our FundsFund of Funds

Long-Biased, 10 Funds

Opportunistic Fund

Market-Neutral, Direct Fund

Subscribe to Our Crypto Investing Newsletter

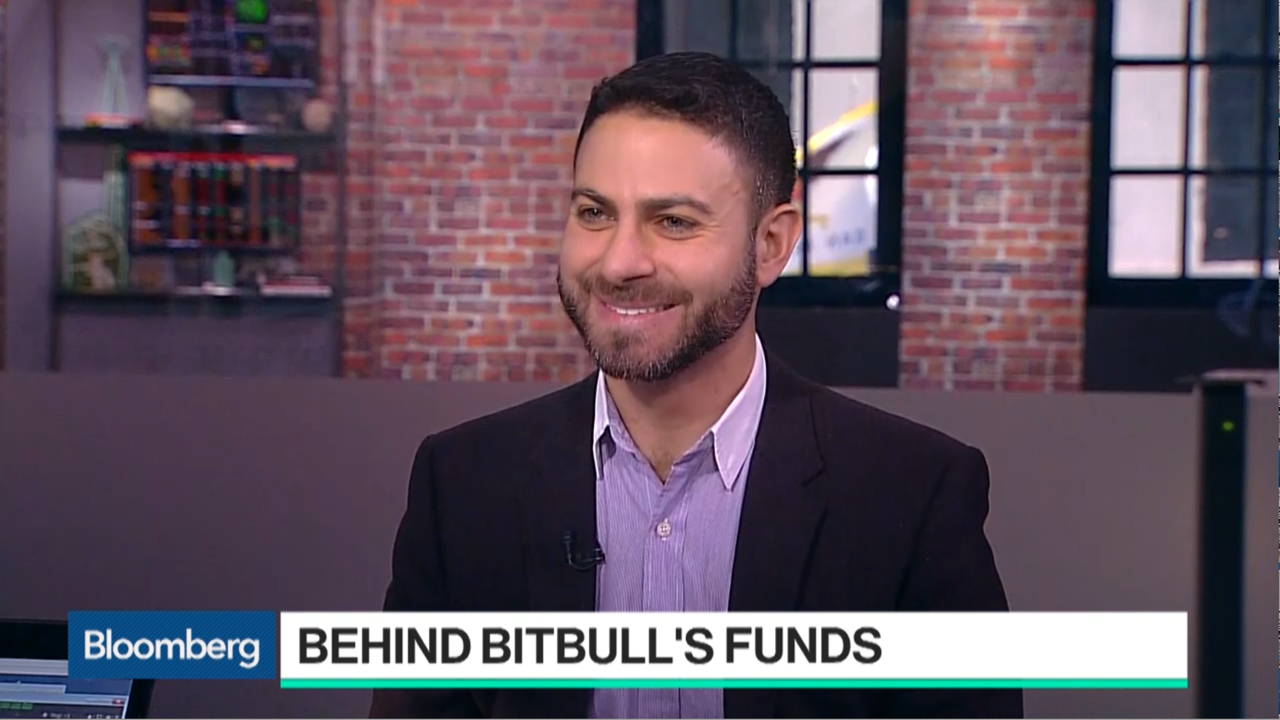

Manager: A 6-year Track Record of Crypto Investing

Joe DiPasquale, CEO of BitBull Capital, has 6 years of experience in investment management, investment banking, and technology.

He completed his BA at Harvard University and MBA at Stanford University.

Investor Benefits

Active management aims to limit downside risk associated with indexes, while maximizing upside

Benefit from our diligence on 600+ crypto funds

Opportunistic deals through our network and 10 funds

Access to exclusive/closed and $M-minimum funds

Our Strategies

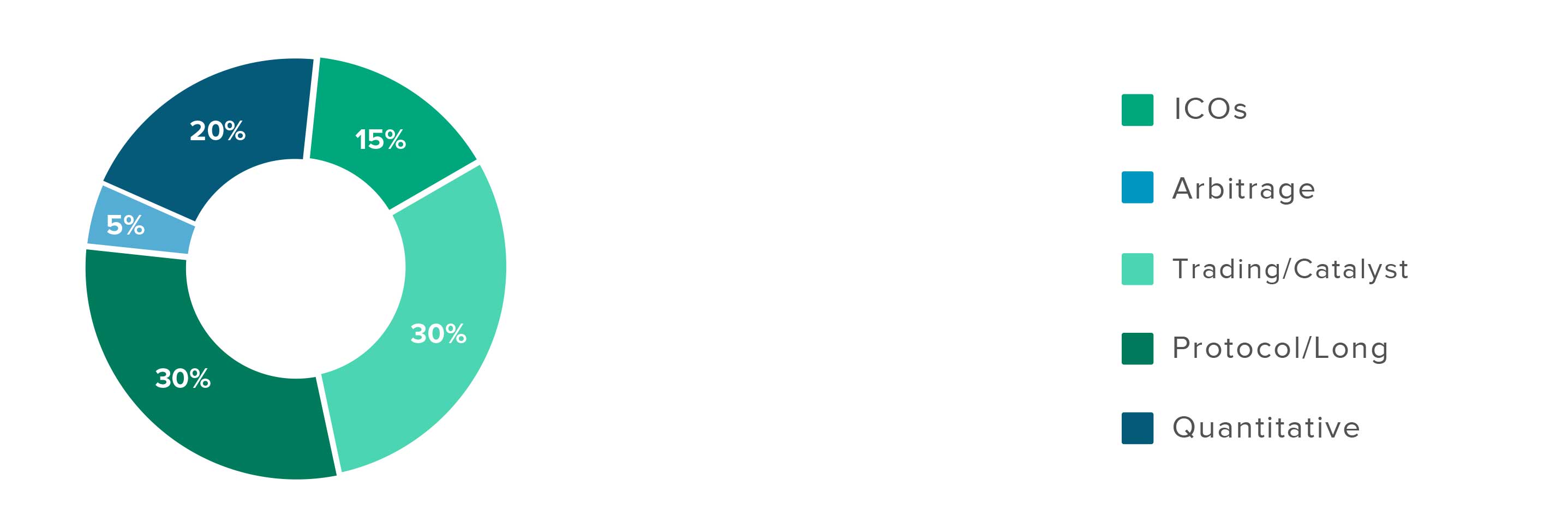

BitBull Capital manages cryptocurrency hedge funds, including BitBull Fund, a crypto fund of funds, and BitBull Opportunistic Fund, which directly invests in opportunistic investments. BitBull Fund manages a strategically selected bundle of 10 of the more than 600 crypto hedge funds for its investors, including gaining access to exclusive, closed funds and $M-minimum funds. As such, BitBull is uniquely positioned to understand the active management strategies and managers in crypto. BitBull Opportunistic Fund is a direct investment vehicle into crypto that leverages this diligence by making specific investments and focusing on specific styles that we believe may return favorably.

BitBull also runs BitBull Research, which regularly publishes the Crypto Investing Newsletter, available for a free subscription at www.bitbullcapital.com, as well as an Opportunistic Deals Memo, available only to investors.

Returns

December 10, 2018, 4pm EST

LAUNCH

FUND OF FUNDS

November 2017

-39.4%

DIRECT FUND

November 2018

-34.4%

STRATEGY

Fund of Crypto Hedge Funds; 10 funds using strategies from pre-ICO to arbitrage

-39.4%

Opportunistic; investments within crypto assets based on opportunities we find

-34.4%

WEIGHTING

Mostly Long; some Market-Neutral

-39.4%

Mostly Market-Neutral; some Long

-34.4%

A Few of Our Funds

BitBull manages a strategically selected bundle of 10 of the more than 600 crypto hedge funds for its investors, including gaining access to exclusive, closed funds and $M-minimum funds. As such, BitBull is uniquely positioned to understand all of the active management strategies and managers in crypto.

In addition, BitBull does opportunistic deals that rise to the top from its diligence. Its diversified active management strategy aims to reduce volatility and has historically produced outsized returns. While Bitcoin was up about 1400% in 2017, BitBull’s research shows select active managers were up an average of 3800%. BarclayHedge named BitBull a top performing multi-advisor fund in April and July 2018.

COMPARISON OF OUR FUNDS

Returns

December 10, 2018, 4pm EST

LAUNCH

FUND OF FUNDS

November 2017

-39.4%

DIRECT FUND

November 2018

-34.4%

STRATEGY

Fund of Crypto Hedge Funds; 10 funds using strategies from pre-ICO to arbitrage

-39.4%

Opportunistic; investments within crypto assets based on opportunities we find

-34.4%

WEIGHTING

Mostly Long; some Market-Neutral

-39.4%

Mostly Market-Neutral; some Long

-34.4%

ASSETS

Public and private crypto assets (including pre-ICOs and equity in blockchain companies)

-39.4%

Public crypto assets

-34.4%

EDGE

Access to vetted, closed, exclusive and/or high-minimum crypto hedge funds

-39.4%

Small, nimble, direct fund

-34.4%

RETURNS

Available via call

-39.4%

Available via call

-34.4%

INTERNATIONAL INVESTORS

Yes

-39.4%

Yes

-34.4%

DOMICILE OF FUND

US or BVI

-39.4%

US*

-34.4%

ACCREDITED STATUS

Must be accredited

-39.4%

Must be accredited

-34.4%

MONTHLY INVESTOR CALL

Yes

-39.4%

No

-34.4%

OPPORTUNISTIC DEAL MEMOS

Yes

-39.4%

Yes

-34.4%

MINIMUM INVESTMENT

$100,000

-39.4%

$25,000

-34.4%

SUBSCRIPTIONS

Monthly

-39.4%

Monthly

-34.4%

LOCK-UP

None**

-39.4%

None

-34.4%

REDEMPTIONS

Quarterly, 95 days’ notice

-39.4%

Monthly, 30 days’ notice

-34.4%

MANAGEMENT FEE

1%

-39.4%

2%

-34.4%

PERFORMANCE FEE

10%

-39.4%

20%

-34.4%

HURDLE

10% hurdle***

-39.4%

No

-34.4%

*International investors can still invest through our US fund

** Optional side-letter provides no-lock up with performance crystallized quarterly

*** 0% peformance fees if we do not provide a return of 10% or more per year (or 2.5% per quarter)

SERVICE PROVIDERS

Trident

Administrator

Richey May

Auditor

Harney’s

Offshore Counsel

DMS

Regulatory Counsel

Cole Frieman Mallon

US Counsel

Become An Investor Today

FREQUENTLY ASKED QUESTIONS

Does BitBull accept non-US investors?

What is an Accredited Investor?

Can I invest through an IRA?

How can I see the performance of my investment?

How do I make an additional investment, after I’ve already made an initial one?

Do you accept in-kind (e.g. investments in bitcoin instead of dollars)?

DISCLAIMER – This material does not constitute an offer or solicitation to purchase an interest in BitBull Capital Funds or any related vehicle, which such offer will only be made via a confidential offering memorandum. An investment in the fund is speculative and is subject to a risk of loss, including a risk of principal. There is no secondary market for interests in the Funds and none is expected to develop. No assurance can be given that the fund will achieve its objective or that an investor will receive a return of all or part of its investment. This material contains certain forward-looking statements and projections regarding the future performance and asset allocation of the Funds. These projections are included for illustrative purposes only, are inherently speculative as they relate to future events, and may not be realised as described. These forward-looking statements will not be updated in the future. Returns for each investor and investment series will differ based on the timing of capital contributions.