From an historic perspective the volatility that 2022 brought was nothing new for cryptocurrency investors. Booms and subsequent busts culminating in massive bear markets are just as old as cryptocurrency itself. Volatility is what attracts many newcomers to the space in the first place but to their surprise works not only in one way but also in the other.

Towards the bottom of cryptocurrency bear markets opponents of the industry always become vocal and proclaim the death of the technology. Yet they fail to realize that extreme sell offs are just the other side of mind blowing rallies. So far cryptocurrencies have recovered from every massive downturn and came back stronger. There have always been some altcoins that boomed during one market cycle and thereafter never made it back. But the core pillars of the industry, Bitcoin and Ethereum, so far always came back stronger along with the ever growing total market capitalization of the industry.

Assessing the Macroeconomic Environment

An important factor to consider for cryptocurrency prices are macro variables such as the inflation rate, economic activity, US Dollar strength and interest rates.

2022 was a terrible year for cryptocurrencies and risk assets in general because the Federal Reserve increased its interest rate from 0% to more than 4%. Looking forward it is unlikely that the Federal Reserve will hike interest rates further than the 25 basis points projected for February 2023. Besides, the bond market is already pricing in a reduction of interest rates for 2023 based on the assumption that inflation will cool down. Decreasing interest rates could potentially be very positive for cryptocurrencies and technology stocks which got sold off heavily in 2022 as a consequence of the restrictive interest environment.

The valuation of crypto and technology assets depends strongly on interest rates because a lot of their value comes from revenue streams that will be generated in the future. However, with higher interest rates these future revenue streams get discounted stronger and are worth less today.

With the prospect of inflation peaking the tide might turn in the other direction and cryptocurrencies could get tailwind from the monetary policy of central banks.

The Promises of Crypto Are Not Yet Achieved

Satoshi released the Bitcoin white paper in October 2008. Ever since the promises of Bitcoin and cryptocurrency have not yet been delivered. The list of promises that crypto should provide us with is very long. One of the main promises of Bitcoin and cryptocurrency was delivering an alternative and instant payment system. The objective was to be faster and cheaper than banks especially when it came to international wire transfers.

However, the early years of Bitcoin were marked by extreme price volatility and the adoption of Bitcoin as a payment system failed. In 2017 the popularity of the Bitcoin blockchain increased and reached a wider mainstream for the very first time. As a consequence transaction fees on the Bitcoin blockchain increased due to the increased demand. The fees got so high that small value transfers were no longer feasible on the Bitcoin blockchain. The original promise of Bitcoin to bank the unbanked was no longer achievable since particularly the poorest demographics were not able to pay for the high fees on the Bitcoin blockchain.

Parts of the Bitcoin community proposed to change the parameters of the network in order to lower transaction costs. However, these changes would also reduce the security of the Bitcoin network. The proponents of lower transaction fees and the usage of Bitcoin as a peer to peer cash system gathered around a community that came by the name ‘Bitcoin Cash’. However, these changes were not supported by the majority of the Bitcoin community.

In August 2017 the Bitcoin Cash Fork occurred in which the ‘Bitcoin Cash’ community created their own version of the Bitcoin blockchain. After splitting apart the Bitcoin Cash ($BCH) community set out on a mission to implement the original vision of implementing a peer to peer electronic cash system. One year later $BCH decreased in value in relation to Bitcoin Core ($BTC) and it became apparent that there was no product market fit for a peer to peer electronic cash system as envisaged by the Bitcoin Cash community. The narrative of Bitcoin as a payment system subsequently faded away.

After the fork the peer to peer electronic cash system narrative was abandoned by the remaining Bitcoin Core ($BTC) community. Instead Bitcoin was positioned as a hedge against inflation. The protection against the devaluation of fiat currencies such as the US Dollar or the Japanese Yen was the new narrative that ‘Bitcoiners’ told to newcomers that were interested in joining the platform.

2022 was the year of the largest inflation in the West since the Bitcoin network went live in January 2009. However, despite the high inflation Bitcoin failed as an inflation hedge in 2022 and lost 65% of its value during the year.

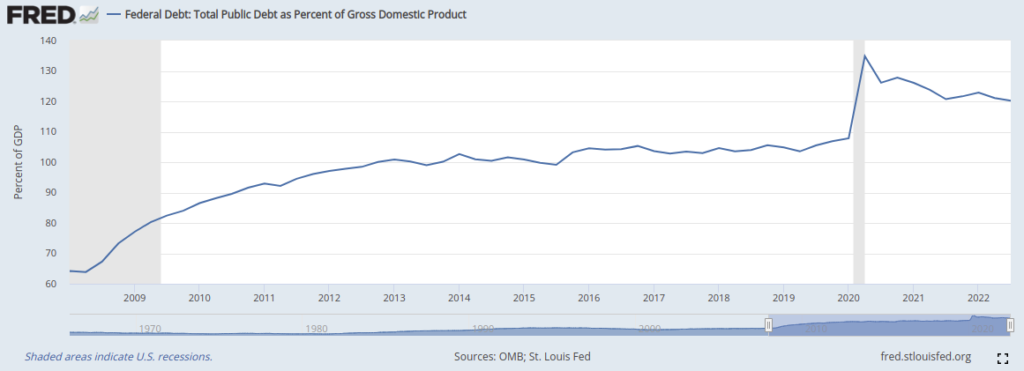

As a consequence the Bitcoin community positioned their asset as a protection against the debasement of fiat currencies in the light of an ever increasing amount of government debt.

Based on these views Bitcoin protects investors against excess liquidity and low interest rates that drain the value of fiat currencies. On the other hand it serves less of a protection in an environment in which the central banks tighten the financial conditions by raising interest rates and removing liquidity from the financial markets as it happened in the inflationary year 2022.

The Advent of Smart Contract Platforms

Since the invention of Ethereum and programmable blockchains the ambitions of the industry have expanded. Some developers started to build an alternative decentralized financial system. However, adoption of DeFi so far has been limited in particular due to a lack of regulatory clarity.

Other developers started to experiment with games that would store items on an immutable blockchain ledger. The potential use cases of Web 3.0 and decentralized domains are manifold. Yet despite all the promises that these areas hold so far none of these use cases had its breakthrough moment and achieved mainstream adoption.

Furthermore, the available technology was not yet ready to serve the masses. During the peak of the NFT hype the Ethereum blockchain became so congested that the gas fees went so high that ordinary people could no longer afford to use the blockchain. Other blockchains like Solana counted with lower fees but experienced network outages questioning the reliability of the blockchain.

Future Outlook

Nevertheless there remains hope. During one of the biggest corrections of the cryptocurrency market Ethereum migrated its consensus mechanism from Proof of Work to Proof of Stake and turned into an environmentally friendly technology reducing energy consumption by more than 99%.

Additionally, developer activity continued to increase throughout the bear market. New all time highs for first time commits by developers were recorded in 2022. Overall the number of monthly active developers increased by almost 300% since 2018. Developers kept working relentlessly on building the promises of crypto and at the same time improving usability so that the masses can be onboarded.

On top layer 2 scaling solutions were delivering big advances in 2022 and are providing the ground to deliver a higher scalability during the next bull market when the masses will arrive again to crypto. As crypto products gain maturity it is becoming more and more likely that in the next market cycle some of these previously hyped niches will eventually gain adoption beyond the crypto niche.