BitBull Capital

We strive to deliver the most effective research, market commentary and investment opportunities for individual and institutional investors.

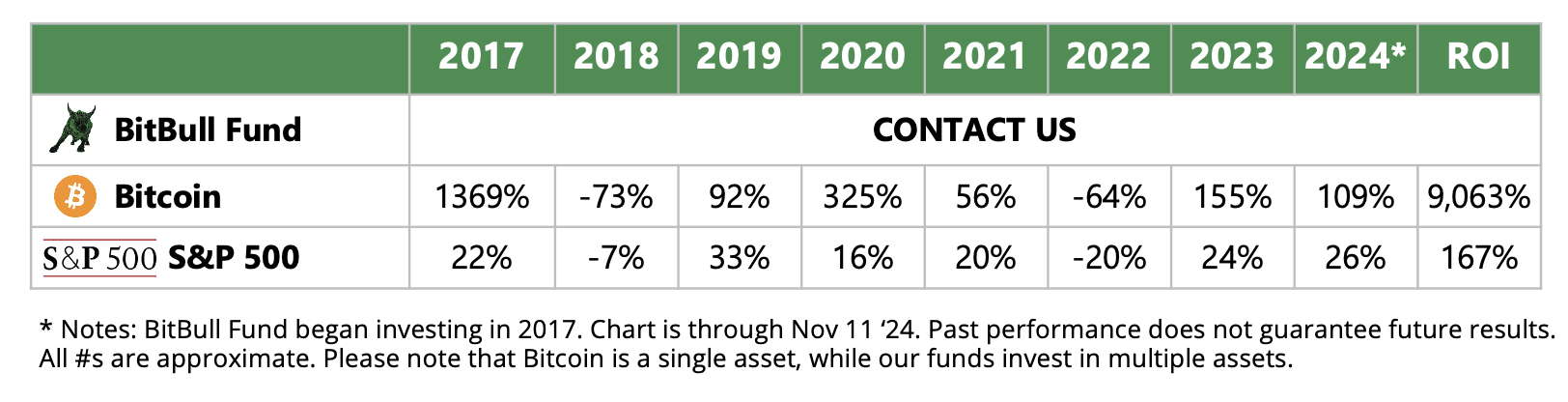

BitBull Fund

Crypto investment fund since 2017

- We believe in diversified, actively-managed strategies.

- We have a track record of success, are a trusted manager in crypto, and include 3rd-party admin and annual K1s.

- To learn more, contact us or read our press.

Joe DiPasquale and Emily Chang discuss factors that influenced the price drop in Bitcoin and crypto in general on Bloomberg.

Coinbase

We provided our investors with equity in Coinbase, a leading crypto exchange, at a $1.5B valuation. Coinbase went public at a $86B valuation. This deal was sought after and not available to many.

MEMO

Investor-only Opportunistic

Deal Memo

2013

Crypto

Investors

since 2013

ACCESS

Access to Funds

With $1Million

Minimum

DILIGENCE

Diligence on

100s of Crypto

Funds

Active management can outperform an index

Index

Vs

Hedge Fund

Crypto Fund Investors

High-net-worth individuals

Nearly 30% of high net worth individuals are very interested in crypto and we continue to help them get exposure to space.

Family offices

Family offices with significant assets—both SFOs and MFOs—seek diversification and turn to us for help adding cryptocurrency investments to their portfolios.

Angel Groups/Angel Investors

Angel investors are continually looking for early opportunities in rapidly growing sectors and we help them identify and invest in early-stage crypto ventures with disruptive potential.

Venture Capitalists

Venture capitalists trying to balance their investment portfolios are increasingly taking interest in high-quality crypto and blockchain ventures with long-term feasibility.

Private Banks/Wealth Managers

We are helping private wealth managers and banks with significant assets under management understand and include cryptocurrencies in their portfolios.

Global Investors

Through our BVI entity, several non-US investors—for example, from Europe, East Asia, the Middle East, and Latin America—turn to us for safe, secure and reliable management of their crypto assets and investments.

Institutional investors

Following the lead of some of the biggest university endowments and pension funds, an increasing number of small and medium bodies are interested in exposure to crypto.

RIAs and Money Managers

Due to mounting client demand, investment advisors and money managers are turning to BitBull to help diversify client portfolios.

Joe DiPasquale

CEO

Sarah Bergstrand

COO

Miko Matsumura

Venture Partner

Constantin Kogan

Partner

Jon Quinn

Investor Relations

Lindsay Joo

Advisor

Kindley Simpson

Human Resources Manager

Selecting a Crypto Hedge Fund

The Perennial Dip

BitBull Capital Launches Two New Innovative Crypto Hedge Funds

BitBull Capital offers investors direct, early-stage access to crypto projects through its new Alpha Fund, and market-neutral DeFi Yield Farming returns through its new Yield Fund. BitBull Capital, which has pioneered innovative crypto hedge fund strategies since...

The Bitcoin Four Year Cycle

Since the very beginning Bitcoin has been a volatile asset and so have been the hedge funds that invested in the cryptocurrency space. There